The Atlantic Refinery Corporation ( ARC) is a public company headquartered in St. Johns, Newfoundland. On 31

Question:

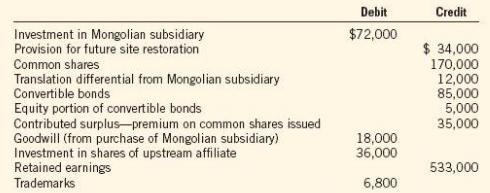

The Atlantic Refinery Corporation ( ARC) is a public company headquartered in St. John’s, Newfoundland. On 31 December 20X5, the post- closing trial balance included the following accounts ( in thousands of Canadian dollars):

The following transactions and events occurred during 20X6:

a. Net income amounted to $ 47 million.

b. The value of trademarks was written off after ARC lost a patent protection lawsuit.

c. An additional $ 1.5 million of convertible bonds was transferred from the debt portion to the equity portion.

d. An accounting policy was changed due to a new IFRS taking effect in 20X6; the effect of retrospective restatement was to reduce prior years’ earnings by an aggregate amount of $ 31 million.

e. The future liability for site restoration was increased by $ 5 million.

f. Common shares with a stated value of $ 15 million were repurchased on the open market for $ 20 million and cancelled. The original issue price of the shares amounted to $ 18, of which $ 3 million had been credited to contributed surplus.

g. A new class of preferred shares was issued to a major public sector pension plan for $ 85 million to finance future development.

h. Dividends totalling $ 24 million were issued during the year. Of that amount, $ 6 million were declared on 24 December 20X6, payable to shareholders of record on January 15, 20X7.

i. The translated amount of ARC’s investment in Mongolian subsidiary declined by $ 2 mil-lion due to a $2mil-lionduetoa rise in the value of the Canadian dollar.

Required:

Prepare a statement of changes in equity for Atlantic Refinery Corporation for the year ended 31 December 20X6. Explain assumptions you need to make, if any.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0071339476

Volume 1, 6th Edition

Authors: Beechy Thomas, Conrod Joan, Farrell Elizabeth, McLeod Dick I