The bookkeeper for Sam Kaplin Equipment Repair made a number of errors in journalizing and posting, as

Question:

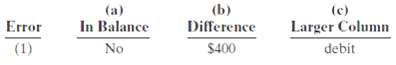

The bookkeeper for Sam Kaplin Equipment Repair made a number of errors in journalizing and posting, as described below.1. A credit posting of $400 to Accounts Receivable was omitted.2. A debit posting of $750 for Prepaid Insurance was debited to Insurance Expense.3. A collection from a customer of $100 in payment of its account owed was journalized and posted as a debit to Cash $100 and a credit to Service Revenue $100.4. A credit posting of $300 to Property Taxes Payable was made twice.5. A cash purchase of supplies for $250 was journalized and posted as a debit to Supplies $25 and a credit to Cash $25.6. A debit of $475 to Advertising Expense was posted as $457.InstructionsFor each error:(a) Indicate whether the trial balance will balance.(b) If the trial balance will not balance, indicate the amount of the difference.(c) Indicate the trial balance column that will have the larger total.Consider each error separately. Use the following form, in which error (1) is given as anexample.

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Accounting Principles

ISBN: 9780471980193

8th Edition

Authors: Jerry J Weygandt, Donald E Kieso, Paul D Kimmel