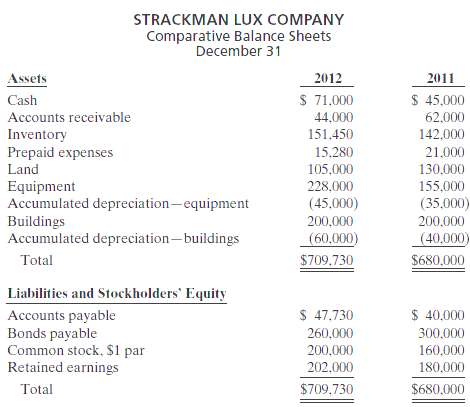

The comparative balance sheets for Strackman Lux Company as of December 31 are presented below. Additional information:1.

Question:

The comparative balance sheets for Strackman Lux Company as of December 31 are presented below.

Additional information:1. Operating expenses include depreciation expense of $42,000 and charges from prepaid expenses of $5,720.2. Land was sold for cash at book value.3. Cash dividends of $15,000 were paid.4. Net income for 2012 was $37,000.5. Equipment was purchased for $95,000 cash. In addition, equipment costing $22,000 with a book value of $10,000 was sold for $6,000 cash.6. Bonds were converted at face value by issuing 40,000 shares of $1 par value common stock.InstructionsPrepare a statement of cash flows for the year ended December 31, 2012, using the indirectmethod.

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Par Value

Par value is the face value of a bond. Par value is important for a bond or fixed-income instrument because it determines its maturity value as well as the dollar value of coupon payments. The market price of a bond may be above or below par,...

Step by Step Answer:

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso