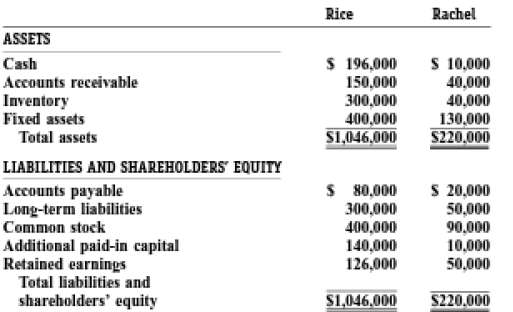

The condensed balance sheets as of December 31 for Rice and Associated and Rachel Excavation are as

Question:

The condensed balance sheets as of December 31 for Rice and Associated and Rachel Excavation are as follows:

As of December 31, the market values of Rachel's inventories and fixed assets were $70,000 and $120,000, respectively. Liabilities are at FMV on the balance sheet.On December 31, Rice and Associates purchased all of the outstanding common shares of Rachel Excavation for $180,000 cash. The preceding balance sheets were prepared immediately prior to the acquisition.REQUIRED:a. Prepare the journal entry recorded by Rice to recognize the acquisition.b. Prepare a consolidated work sheet and a consolidated balance sheet.

Rice Rachel ASSETS $ 196,000 150,000 300,000 400,000 S1,046,000 S 10,000 40,000 40,000 130,000 S220.000 Cash Accounts receivable Inventory Fixed assets Total assets LIABILITIES AND SHAREHOLDERS' EQUITY S 80,000 300,000 400,000 140,000 126,000 S 20,000 50,000 90,000 10,000 50,000 Accounts payable Long-term liabilities Common stock Additional paid-in capital Retained earnings Total liabilities and shareholders' equity S220.000 S1,046,000

Step by Step Answer:

a Investment in Subsidiary A 180000 Cash A 180000 Invested in subsidiary After posting this entry Ri...View the full answer

Related Video

This video is about ways to attempt consolidated balance sheet questions. since the unconsolidated financial statements of parent and subsidiary companies are prepared separately, consolidating the balance sheets of both companies is critical and sometimes becomes complex. the tutorial will guide students on to how questions on attempting questions on consolidated financial statements in an easier yet more effective way.

Students also viewed these Accounting questions

-

The condensed balance sheets as of December 31 for Rice and Associates and Rachel Excavation are as follows: As of December 31, the market values of Rachels inventories and property, plant, and...

-

The following arc Farrell Corporations balance sheets as of December 31, 2016, and 2015, and the statement of income and retained earnings for the year ended December 31,2016: Additional information:...

-

Selected data from Emporia Company follow: Balance Sheets As of December 31 2018 2017 Accounts receivable................................ $600,000......................... $480,000 Allowance for...

-

In using the bolt cutter shown, a worker applies two 300-N forces to the handles. Determine the magnitude of the forces exerted by the cutter on the bolt. 300 N 12 mm 24 mm E 24 mm 460 mm 96 mm 300 N...

-

Tilger Farm Supply Company manufactures and sells a fertilizer called Snare. The following data are available for preparing budgets for Snare for the first two quarters of 2012. 1. Sales: Quarter 1,...

-

Can you brainstorm what costs it would be difficult to control and cut?

-

(intention to comply with the unethical request). Summary statistics on the 86 scores follow: x = 2.42, s = 2.84. a. Estimate m, the mean intention to comply score for the population of all...

-

What was Facebooks accounting effective tax rate for 2018? What items caused the companys accounting effective tax rate to differ from the hypothetical tax rate of 21 percent? What was the companys...

-

Direct material efficiency variance is the difference between a. (Standard units used Actual units used) * Standard price b. (Standard units used + Actual units used) * Standard price c. (Standard...

-

Bearland Manufacturing produces 4 different types of wood paneling. Each type of paneling is made by gluing and pressing together a different mixture of pine and oak chips. The following table...

-

Excerpts from the financial statements of Macy Limited are as follows. (Numbers are in thousands.) Footnotes:Short-term investments.As of December 31, 2010, trading securities were valued at $130;...

-

Assume that Rice and Associates in P8-11 purchased 80 percent of the outstanding shares of Rachel for $136,000 cash. REQUIRED: a. Prepare the journal entry recorded by Rice to recognize the...

-

In Problem determine the value v of the matrix game. Is the game fair? -3 5 47 -2.

-

Idenfity whether the following book - tax adjustments are permanent or temporary differences. ( a ) Federal Income Tax Expense ( b ) Depreciation Expense ( c ) Accrued Compensation ( d ) Dividends...

-

2 . ) Pozycki, LLC has reported losses of $ 1 0 0 , 0 0 0 per year since its founding in 2 0 1 6 . For 2 0 2 3 , Pozycki anticipates a profit of about $ 1 0 0 , 0 0 0 . There are 3 equal members of...

-

Elena is a single taxpayer for tax year 2023. On April 1st, 2022, Elena's husband Nathan died. On July 13, 2023, Elena sold the residence that Elena and Nathan had each owed and used as their...

-

Rodriguez Corporation issues 12,000 shares of its common stock for $56,600 cash on February 20. Prepare journal entries to record this event under each of the following separate situations. 1. The...

-

Problem 3: A large rectangular plate is loaded in such a way as to generate the unperturbed (i.e. far-field) stress field xx = Cy; yy = -C x; Oxy = 0 The plate contains a small traction-free circular...

-

On July 31, Lee Calan Imports advertised a used Volvo station wagon for sale in the Chicago Sun-Times. As part of the information for the advertisement, Lee Calan Imports instructed the newspaper to...

-

B.) What is the approximate concentration of free Zn 2+ ion at equilibrium when 1.0010 -2 mol zinc nitrate is added to 1.00 L of a solution that is 1.080 M in OH - . For [Zn(OH) 4 ] 2- , K f = 4.610...

-

Match each diagram in Figure 1 with its description here. Assume that the economy is producing or attempting to produce at point A and that most members of society like meat and not fish. Some...

-

You can review the Disney SEC Form 10-K by searching for Disney Annual Report online. REQUIRED: Review the Disney 10-K, and answer the following questions: a. What percentage of Disneys total assets...

-

On January 1, 2018, Wilmes Floral Supplies borrowed $2,413 from Bower Financial Services. Wilmes Floral Supplies gave Bower a $2,500 note with a maturity date of December 31, 2019. The note specified...

-

Earl Rix, president of Rix Driving Range and Health Club, has provided you with the following information: The stated annual interest rate on the notes is 10 percent, and interest is paid annually on...

-

How do warehouses and distribution centers differ? What is cross-docking and why might a company choose to cross-dock a product? What kinds of products can be delivered electronically? What kinds...

-

Strawberry Inc. has historically been an all-equity firm. The analyst expects EBIT to be $1.5B in perpetuity starting one year from now. The cost of equity for the company is 11.5% and the tax rate...

-

Guzman company received a 60- day, 5 % note for 54,000 dated July 12 from a customer on account. Determine the due date on note. Determine the maturity value of the note and journalize the entry of...

Study smarter with the SolutionInn App