The Davidson Corporation's balance sheet and income statement are provided here. a. Construct the statement of stockholders'

Question:

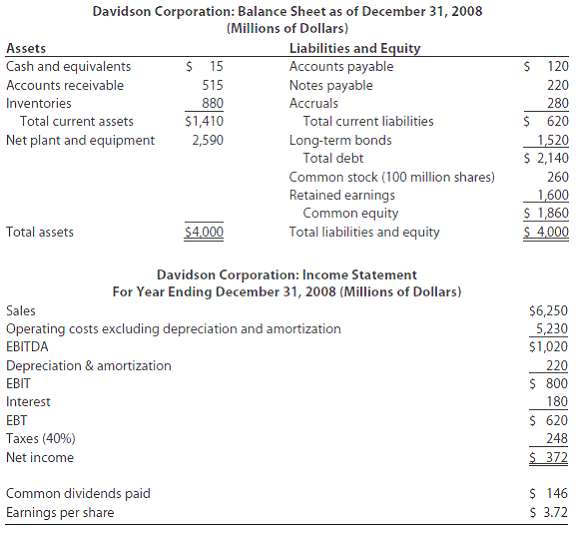

The Davidson Corporation's balance sheet and income statement are provided here.

a. Construct the statement of stockholders' equity for December 31, 2008.b. How much money has been reinvested in the firm over the years?c. At the present time, how large a check could be written without it bouncing?d. How much money must be paid to current creditors within the nextyear?

Transcribed Image Text:

Davidson Corporation: Balance Sheet as of December 31, 2008 (Millions of Dollars) Liabilities and Equity Accounts payable Notes payable Assets Cash and equivalents $ 15 120 515 Accounts receivable 220 280 Inventories 880 Accruals $1,410 $ 620 1,520 $ 2,140 Total current assets Total current liabilities 2,590 Net plant and equipment Long-term bonds Total debt Common stock (100 million shares) 260 Retained earnings Common equity Total liabilities and equity 1,600 $ 1,860 $ 4,000 Total assets $4.000 Davidson Corporation: Income Statement For Year Ending December 31, 2008 (Millions of Dollars) Sales $6,250 5,230 $1,020 Operating costs excluding depreciation and amortization EBITDA Depreciation & amortization EBIT 220 $ 800 Interest 180 $ 620 EBT Taxes (40%) 248 $ 372 Net income $ 146 $ 3.72 Common dividends paid Earnings per share

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (13 reviews)

a Balance of RE December 31 2007 1374 Add NI 2008 372 Less Div paid to common stockholde...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted:

Students also viewed these Finance questions

-

The Shepard Company balance sheet and income statement are provided below: The Shepard Company Balance Sheet December 31, Year 1 Assets Cash $ 40,000 Accounts receivable 52,000 Inventory 80,000 Plant...

-

The following balance sheet and income statement are for Weber Industries. The firms stock currently is priced at $6.00 per share. Calculate and interpret the companys Z score. Weber Industries...

-

A firm has the following balance sheet and income statement (in millions of dollars): The long-term debt is 8 percent coupon debt maturing in five years. The statutory tax rate is 38 percent. Prepare...

-

Write a program, in Java, to convert from binary to decimal andfrom from binary to hexadecimal. Please use instance variables,preferably strings. The program must do the conversion withoutusing any...

-

Lacy is a single taxpayer. In 2016, her taxable income is $40,000. What is her tax liability in each of the following alternative situations? a. All of her income is salary from her employer. b. Her...

-

The point P lies on the line joining A(-2, 3) and B(10, 19) such that AP: PB = 1:3. a. Show that the x-coordinate of P is 1 and find the y-coordinate of P. b. Find the equation of the line through P...

-

What is meant when it is said that an FX forward is substantively two options?

-

Golden Corporation has $20,000,000 of 7 percent, 20-year bonds dated June 1, 2010, with interest payment dates of May 31 and November 30. After 10 years, the bonds are callable at 104, and each...

-

If customer demand is 203,000 units per month, and available manufacturing capacity is 4,000 hours per week, what is the Takt time for this firm? (Round your answer to 2 decimal places.) Takt time...

-

Every Friday, Kylies Recruiting Services records its employees weekly salaries of $20,000 per week ($4,000 per day, Monday through Friday). Employees are paid the following week on Thursday. Required...

-

Hermann Industries is forecasting the following income statement: Sales $8,000,000 Operating costs excluding depr. & amort. 4,400,000 EBITDA $3,600,000 Depreciation & amortization 800,000 EBIT...

-

Financial information for Powell Panther Corporation is shown here. a. What was net working capital for 2007 and 2008?b. What was the 2008 free cash flow?c. How would you explain the large increase...

-

What are some of the key obstacles for the FASB and IASB within its accounting guidance in the area of cash flow reporting? Explain.

-

In this problem, we consider mild modifications of the standard MDP setting. (a) (10 points) Sometimes MDPs are formulated with a reward function R(s) that depends only on the current state. Write...

-

All-Walnut, Inc. produces two models of bookcases. The bookcases sell for the amount listed in the table below. Each bookcase requires a certain number of labor hours, machine time, and materials...

-

Problem 1 Find the number of degrees of freedom of the mechanisms (a)-(d) (a) (b)

-

3) (10 pts) The following grammar is given E EAE (E) -E | id V={E,A), T={-,(,),*,/,+,id} and starting symbol is E. a) Give the left-most derivation of w= id+id*id. Is w accepted? b) Is this a...

-

4. X, the proprietor of a departmental store, decided to calculate separate profits for his two departments L and M for the month ending 31st January. Stock on 31st January could not be valued for...

-

What is a monopoly? What is market power? How do these concepts relate to each other? AppendixLO1

-

The senior management at Davis Watercraft would like to determine if it is possible to improve firm profitability by changing their existing product mix. Currently, the product mix is determined by...

-

Calculate the present value of the following liabilities under an interest rate of i = 7% per annum. a. 1m due in 6.5 years. b. 3.50 due in 4 months. c. 10,000 due in 30 years.

-

Identify and briefly discuss five major factors that complicate financial management in multinational firms.

-

Discuss the following statement: The United States is not immune to the influence of foreign corporations over U.S. economic and political policies.

-

Why do companies go global?

-

Each week you must submit an annotated bibliography. Entries of current events relating to the economic concepts and the impact on the company or the industry of your company. You must use acceptable...

-

Fluffy Toys Ltd produces stuffed toys and provided you with the following information for the month ended August 2020 Opening WIP Units 5,393 units Units Started and Completed 24,731 units Closing...

-

Part A Equipment 1,035,328 is incorrect Installation 44,672 is incorrect Anything boxed in red is incorrect sents 043/1 Question 9 View Policies Show Attempt History Current Attempt in Progress...

Study smarter with the SolutionInn App