The finance director of RM plc is considering several investment projects and has collected the following information

Question:

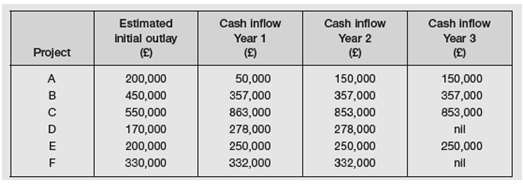

The finance director of RM plc is considering several investment projects and has collected the following information about them.

Projects D and E are mutually exclusive. The capital available for investment is limited to £1m in the first year. All projects are divisible and none may be postponed or repeated.

The cost of capital of RM plc is 15 per cent.

(a) Discuss the possible reasons why RM plc may be limited as to the amount of capital available for investment in its projects.

(b) Determine which investment projects the finance director of RM plc should choose in order to maximise the return on the capital available for investment. If the projects were not divisible, would you change your advice to the finance director?

(c) Critically discuss the reasons why net present value is the method of investment appraisal preferred by academics. Has the internal rate of return method now been made redundant?

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Corporate Finance Principles and Practice

ISBN: 978-1292103037

7th edition

Authors: Denzil Watson, Antony Head