The following are extracts from two newsletters sent to a stockbroker?s clients: Investment Letter?March 2001. Kipper Parlors

Question:

The following are extracts from two newsletters sent to a stockbroker?s clients: Investment Letter?March 2001. Kipper Parlors was founded earlier this year by its president, Albert Herring. It plans to open a chain of kipper parlors where young people can get together over a kipper and a glass of wine in a pleasant, intimate atmosphere. In addition to the traditional grilled kipper, the parlors serve such delicacies as Kipper Schnitzel, Kipper Grandemere, and (for dessert) Kipper Sorbet.

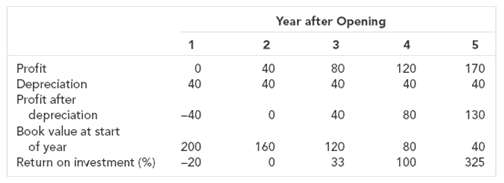

The economics of the business are simple. Each new parlor requires an initial investment in fixtures and fittings of $200,000 (the property itself is rented). These fixtures and fittings have an estimated life of 5 years and are depreciated straight-line over that period. Each new parlor involves significant start-up costs and is not expected to reach full profitability until its fifth year. Profits per parlor are estimated as follows:

Kipper has just opened its first parlor and plans to open one new parlor each year. Despite the likely initial losses (which simply reflect start-up costs), our calculations show a dramatic profit growth and a long-term return on investment that is substantially higher than Kipper?s 20 percent cost of capital.

The total market value of Kipper stock is currently only $250,000. In our opinion, this does not fully reflect the exciting growth prospects, and we strongly recommend clients to buy. Investment Letter?April 2001

Albert Herring, president of Kipper Parlors, yesterday announced an ambitious new building plan. Kipper plans to open two new parlors next year, three the year after, and so on we have calculated the implications of this for Kipper?s earnings per share and return on investment. The results are extremely disturbing, and under the new plan, there seems to be no prospect of Kipper?s ever earning a satisfactory return on capital. Since March, the value of Kipper?s stock has fallen by 40 percent. Any investor who did not heed our earlier warnings should take the opportunity to sell the stock now. ?Compare Kipper?s accounting and economic income under the two expansion plans. How does the change in plan affect the company?s return on investment? What is the PV of Kipper stock? Ignore taxes in your calculations.

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers