The following balance sheet is presented for J.D.F Company as of December 31, 2011. During 2012, J.D.F

Question:

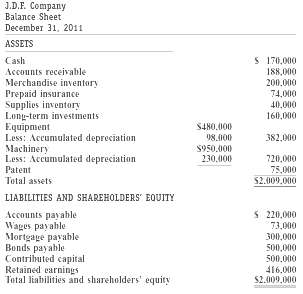

The following balance sheet is presented for J.D.F Company as of December 31, 2011.

During 2012, J.D.F entered into the following transactions.Made credit sales of $1,350,000 and cash sales of $350,000. The cost of the inventory sold was $700,000.Purchased $820,000 of merchandise inventory on account.Made cash payments of $400,000 to employees for salaries. This amount includes the wages due employees as of December 31, 2011.Purchased $110,000 of supplies inventory by issuing a six-month note that matures on March 12, 2013.Collected $850,000 from customers in payment of open accounts receivable.Paid supplies $870,000 for payment of open accounts payable.Sold a long-term investment for $37,000. The investment had been purchased for $30,000.Paid $148,000 in cash for miscellaneous operating expenses.Issued additional common stock for $120,000 cash.On September 30, 2012, a customer gave the company a note due on May 1, 2013, in payment of a $72,000 account receivable.The company declared and paid a cash dividend of $50,000.The company purchased stock in Microsoft as a long-term investment for $50,000.J.D.F used the following information to prepare adjusting journal entries on December 31, 2012.(a) Forty percent of the prepaid insurance on January 1 was still in effect as of December 31, 2012.(b) A physical count of the supplies inventory indicated that the company had $40,000 on hand as of December 31, 2012.(c) A review of the company's advertising campaign indicates that of the expenditures made during 2012 for miscellaneous operating expenses, $25,000 applies to promotions to be undertaken during 2013.(d) The company is charged at a rate of $3,500 per month for certain operating expenses. It paid $36,000 for these expenses during the year.(e) The company owes employees $43,000 for wages as of December 31, 2012.(f) The $72,000 note receivable accepted in payment of an account receivable (see [10] above) specifies an annual interest rate of 9 percent.(g) Equipment has an estimated useful life of ten years, and machinery has an estimated useful life of twenty years. The patent originally cost $125,000 and had an estimated useful life of ten years. The company uses the straight-line method to depreciate and amortize all property plant, equipment, and intangibles.(h) The note issued by the company (see [4] above) has a stated rate of 10 percent and was issued on September 12, 2012.REQUIRED:a. Prepare an income statement, a statement of shareholders' equity, a balance sheet, and a statement of cash flows using the direct form of presentation.b. (Appendix 4A) Prepare the operating section of the statement of cash flows under the indirectmethod.

Common StockCommon stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer: