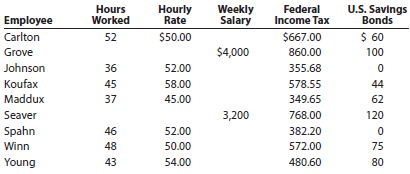

The following data for Flexco Inc. relate to the payroll for the week ended December 9, 2016:

Question:

Employees Grove and Seaver are office staff, and all of the other employees are sales personnel. All sales personnel are paid 1½ times the regular rate for all hours in excess of 40 hours per week. The social security tax rate is 6.0% of each employee€™s annual earnings, and Medicare tax is 1.5% of each employee€™s annual earnings. The next payroll check to be used is No. 328.

Instructions

1. Prepare a payroll register for Flexco Inc. for the week ended December 9, 2016. Use the following columns for the payroll register: Employee, Total Hours, Regular Earnings, Overtime Earnings, Total Earnings, Social Security Tax, Medicare Tax, Federal Income Tax, U.S. Savings Bonds, Total Deductions, Net Pay, Ck. No., Sales Salaries Expense, and Office Salaries Expense.

2. Journalize the entry to record the payroll for the week.

Step by Step Answer:

Financial Accounting

ISBN: 978-1305088436

14th edition

Authors: Carl S. Warren, Jim Reeve, Jonathan Duchac