The following data were summarized from the accounting records for DeSalvo Construction Company for the year ended

Question:

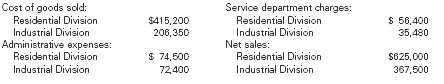

The following data were summarized from the accounting records for DeSalvo Construction Company for the year ended June 30, 2010:

Prepare divisional income statements for DeSalvo ConstructionCompany.

Transcribed Image Text:

Cost of goods scld: Residential Division Industrial Division Administrative expenses: Residential Division Industrial Division Service department charges: Residential Division Industrial Division Net sales: Residential Division Industrial Division $415,200 20,350 $ 56,400 35,480 $ 74,500 72,400 $625,000 367,500

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 43% (16 reviews)

Net sales Cost of goods sold Gross profit Divisional Income Statements For the ...View the full answer

Answered By

Muhammad Khurram

I have strong General Management skills to apply in your projects. Over last 3 years, I have acquired great knowledge of Accounting, Auditing, Microsoft Excel, Microsoft PowerPoint, Finance, Microsoft Project, Taxation, Strategic Management, Human Resource, Financial Planning, Business Planning, Microsoft Word, International Business, Entrepreneurship, General Management, Business Mathematics, Advertising, Marketing, Supply Chain, and E-commerce. I can guarantee professional services with accuracy.

4.80+

249+ Reviews

407+ Question Solved

Related Book For

Question Posted:

Students also viewed these Managerial Accounting questions

-

The following data were summarized from the accounting records for Jersey Coast Construction Company for the year ended June 30, 2016: Prepare divisional income statements for Jersey Coast...

-

The following data were summarized from the accounting records for Huggins Construction Company for the year ended June 30, 2008: Prepare divisional income statements for Huggins ConstructionCompany....

-

The following data were summarized from the accounting records for Endless River Construction Company for the year ended June 30, 2014: Prepare divisional income statements for Endless River...

-

3. Six Sigma College of Business offers five different courses of study. The planned enrollment in each course is 25 students. Registration for the upcoming semester of study has been recently...

-

Refer to the gas mileage hypothesis test of Example 9.23 on page 422. Recall that the null and alternative hypotheses are H0: = 26 mpg (manufacturer's claim) Ha: < 26 mpg (consumer group's...

-

Rick and Maria had been married for 20 years before their divorce in 2019. At that time, they made the usual property settlement: Maria got the house, the van, and the cat; Rick got the mortgage, the...

-

The following data were summarized from the accounting records for Jareau Construction Company for the year ended June 30, 2012: Prepare divisional income statements for Jareau Construction Company.

-

In July 2010, Zinger Corp. purchased 20,000 gallons of Numerol for $61,000 to use in the production of product #43MR7. During July, Zinger Corp. manufactured 3,900 units of product #43MR7. The...

-

Question 2 On January 1, 2008, Forbes Company purchased equipment at a cost of $50,000. The equipment was estimated to have a residual value of $5,000 and it is being depreciated over eight years...

-

Physics instructor Peter Hopkinson delights in bringing physics into social situations. When dining out with friends, he produces resonance in an empty wine glass by rubbing his wetted fingers on its...

-

Partially completed budget performance reports for Iliad Company, a manufacturer of air conditioners, are provided below. a. Complete the budget performance reports by determining the correct amounts...

-

For each of the following service departments, identify an activity base that could be used for charging the expense to the profit center. a. Central purchasing b. Legal c. Accounts receivable d....

-

Refer to Problem 65. The line x 2y + 4 = 0 is tangent to a circle at (0, 2). The line y = 2x 7 is tangent to the same circle at (3, 1). Find the center of the circle. Data from problem 65 If the...

-

Listed below are the amounts (dollars) it costs for marriage proposal packages at different baseball stadiums. Find the range, variance, and standard deviation for the given sample data. Include...

-

The Lotto Case (Hitting the Jackpot) Allen B. Atkins, Roxanne Stell, & Larry Watkins Bob, Chad and Dylan had been dreaming of this day for the past six years; ever since they first met in an...

-

Boxplots. In Exercises 29-32, use the given data to construct a boxplot and identify the 5-number summary. Taxis Listed below are times (minutes) of a sample of taxi rides in New York City. The data...

-

Use the birth weights (grams) of the 400 babies listed in Data Set 6 "Births" in Appendix B. Examine the list of birth weights to make an observation about those numbers. How does that observation...

-

Listed below are annual U.S. sales of vinyl record albums (millions of units). The numbers of albums sold are listed in chronological order, and the last entry represents the most recent year. Do the...

-

Every 10 years, the U.S. Census Bureau asks people about the number of people living within their households. The following list shows how eight households responded to the question. 5 1 2 6 4 4 3 5...

-

Question 6.10 Current and deferred tax worksheets and tax entries From the hip Ltd?s statement of profit or loss for the year ended 30 June 2007 and extracts from its statements of financial position...

-

Location-based services are probably the most commercialized GIS-related field. Search for location-based service on Wikipedia (http://www.wikipedia.org/) and read what has been posted on the topic.

-

What information should a lessee disclose about its capital leases in its financial statements and footnotes?

-

How should a less or measure its initial gross investment in either a sales-type lease or a direct-financing lease?

-

On January 1, 2011, Evans Company entered into a non-cancelable lease for a machine to be used in its manufacturing operations. The lease transfers ownership of the machine to Evans by the end of the...

-

Question 24 Not yet answered Marked out of 1.00 P Flag question Muscat LLC's current assets and current liabilities are OMR 258,000 and OMR 192,000, respectively. In the year 2020, the company earned...

-

Question 24 Miami Company sold merchandise for which it received $710,400, including sales and excise taxes. All of the firms sales are subject to a 6% sales tax but only 50% of sales are subject to...

-

f the IRS intends to close a Taxpayer Assistance Center, they must notify the public at least _____ days in advance of the closure date. 14 30 60 90

Study smarter with the SolutionInn App