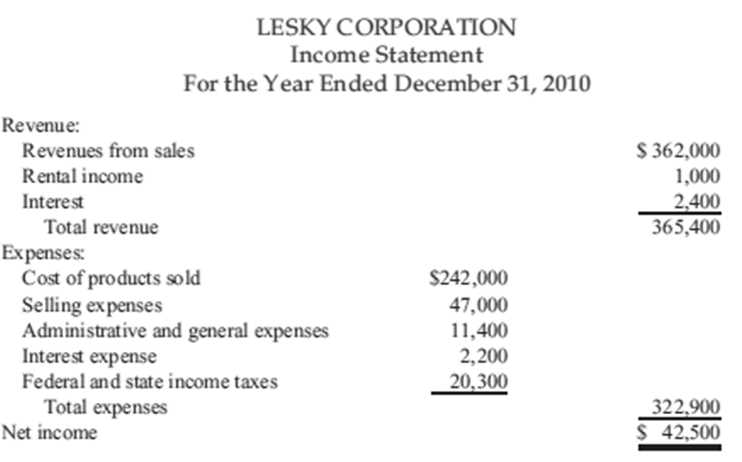

The following information for Lesky Corporation covers the year ended December 31, 2010: Required Change this statement

Question:

The following information for Lesky Corporation covers the year ended December 31, 2010:

Required

Change this statement to a multiple-step format, as illustrated in this chapter.

Transcribed Image Text:

LESKY CORPORATION Income Statement For the Year Ended December 31, 2010 Revenue: Revenues from sales Rental income Interest S362,000 1,000 2 400 365,400 Total revenue Expenses: Cost of products sold Selling ex penses Administrative and general expenses Interest expense Federal and state income taxes $242,000 47,000 11,400 2,200 20.300 Total expenses 322.900 42,500 Net income

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 58% (17 reviews)

Lesky Corporation Income Statement For the Year Ended December 31 2010 Revenue from sales 3620...View the full answer

Answered By

Surojit Das

I have vast knowledge in the field of Mathematics, Business Management and Marketing. Besides, I have been teaching on the topics Management leadership, Business Administration, Human Resource Management, Business Communication, Accounting, Auditing, Organizer Behaviours, Business Writing, Essay Writing, Copy Writing, Blog Writing since 2020. It is my personality to act quickly in any emergency situations when students need my services. I am very professional and serious in every questions students asked me at the time of dealing any projects. I have been serving detailed, quality, properly analysed research paper through the years.

4.80+

91+ Reviews

279+ Question Solved

Related Book For

Financial Reporting And Analysis Using Financial Accounting Information

ISBN: 139

12th Edition

Authors: Charles H Gibson

Question Posted:

Students also viewed these Accounting questions

-

The income statement for Delta-tec Inc. for the year ended December 31, 2016, was as follows: Delta-tec Inc. Income Statement (selected items) For the Year Ended December 31, 2016 1 Income from...

-

For the year ended December 31, 2013, Ebanks, Inc., earned an ROI of 12%. Sales for the year were $150 million, and average asset turnover was 2.5. Average stockholders equity was $50 million....

-

A six-lane freeway (three lanes in each direction) in a scenic area has a measured free-flow speed of 88.5 km/h. The peak-hour factor is 0.80, and there are 8% large trucks and buses and 6%...

-

On December 31, 2015, analysis of Sayer Sporting Goods' operations for 2015 revealed the following. (a) Total cash collections from customers, $105,260. (b) December 31, 2014, inventory balance,...

-

The. REP: (a) details the requests of users to be included in the system. (b) lists the requirements identified in the requirements investigation stage. (c) details requirements for potential vendors...

-

0.317

-

Keynote Inc. uses a calendar year for financial reporting. The company is authorized to issue 20,000,000 shares of $1 par common stock . At no time has Keynote issued any potentially dilutive...

-

Sandhill Company produces golf discs which it normally sells to retailers for $ 7 each. The cost of manufacturing 18,600 golf discs is: Materials $ 8,556 Labor 29,016 Variable overhead 19,530 Fixed...

-

The box plot below shows the amount spent for books and supplies per year by students at four year public colleges. a. Estimate the median amount spent. b. Estimate the first and third quartiles for...

-

The following information for Decher Automotives covers the year ended 2010: Administrative expense ............. $ 62,000 Dividend income ............... 10,000 Income taxes .....................

-

The accounts of Consolidated Can contain the following amounts at December 31, 2010: Cost of products sold ............. $410,000 Dividends ................. 3,000 Extraordinary gain (net of tax)...

-

How does a company record the purchase of direct materials (on credit) in a standard cost system? TKY-1

-

The following information is available for two different types of businesses for the 2011 accounting period. Dixon Consulting is a service business that provides consulting services to small...

-

Marino Basket Company had a \(\$ 6,200\) beginning balance in its Merchandise Inventory account. The following information regarding Marino's purchases and sales of inventory during its 2011...

-

On March 6, 2011, Bob's Imports purchased merchandise from Watches Inc. with a list price of \(\$ 31,000\), terms \(2 / 10, n / 45\). On March 10, Bob's returned merchandise to Watches Inc. for...

-

The following events apply to Tops Gift Shop for 2012, its first year of operation: 1. Acquired \(\$ 45,000\) cash from the issue of common stock. 2. Issued common stock to Kayla Taylor, one of the...

-

Indicate whether each of the following costs is a product cost or a period (selling and administrative) cost. a. Transportation-in. b. Insurance on the office building. c. Office supplies. d. Costs...

-

Describe the most rewarding and most stressful aspects of your job or your college experience.

-

The following information is for Montreal Gloves Inc. for the year 2020: Manufacturing costs Number of gloves manufactured Beginning inventory $ 3,016,700 311,000 pairs 0 pairs Sales in 2020 were...

-

What are the components of a visitor management programme?

-

At the end of 2006, Dolf Company prepared the following schedule of its deferred tax items (based on the currently enacted tax rate of 30%): On April 30, 2007 Congress changed the income tax rate to...

-

Colt Company reports pretax financial income of $143,000 in 2007. In addition to pretax income from continuing operations (of which revenues are $295,000), the following items are included in this...

-

At the beginning of 2007 Norris Company had a deferred tax liability of $6,400, because of the use of MACRS depreciation for income tax purposes and units-of-production depreciation for financial...

-

What is the duration for the following bond with annual payments? 5.6300 5.7957 4.9894 5.1910 5.3806

-

DOLLAR TREE GROCERY OUTLET Short-Term Liquidity 2021 2022 2021 2022 Current Ratio 1.35 1.51 1.86 1.67 Quick Ratio 0.24 0.15 0.63 0.42 Cash Ratio Cash Conversion Cycle 34.78 45.75 19.41 21.61 Days...

-

A family has a $117,443, 25-year mortgage at 5.4% compounded monthly. (A) Find the monthly payment and the total interest paid. (B) Suppose the family decides to add an extra $100 to its mortgage...

Study smarter with the SolutionInn App