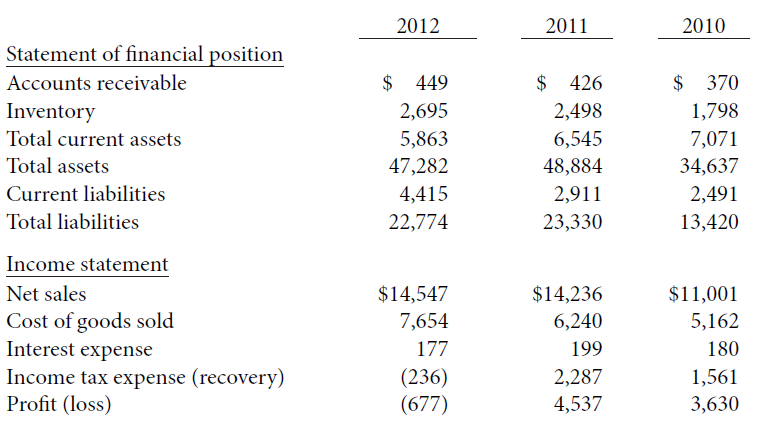

The following selected information was taken from Barrick Gold Corporation's financial statements (in U.S. $ millions): Instructions

Question:

The following selected information was taken from Barrick Gold Corporation's financial statements (in U.S. $ millions):

Instructions

(a) Calculate each of the following ratios for 2012 and 2011. Industry ratios are shown in parentheses.

1. Current ratio (2012, 2.3:1; 2011, 2.4:1)

2. Receivables turnover (2012, 19.0 times; 2011, 19.1 times)

3. Inventory turnover (2012, 3.7 times; 2011, 4.0 times)

4. Debt to total assets (2012, 20.6%; 2011, 20.6%)

5. Times interest earned (2012, 17.3 times; 2011, 18.9 times)

(b) Based on your results in part (a), comment on Barrick Gold's liquidity and solvency.

(c) Barrick Gold has three pages of disclosure in the notes to its statements about pending litigation. Discuss the implications of this information for your analysis.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine