The following yield data for a number of highest-quality corporate bonds existed at each of the three

Question:

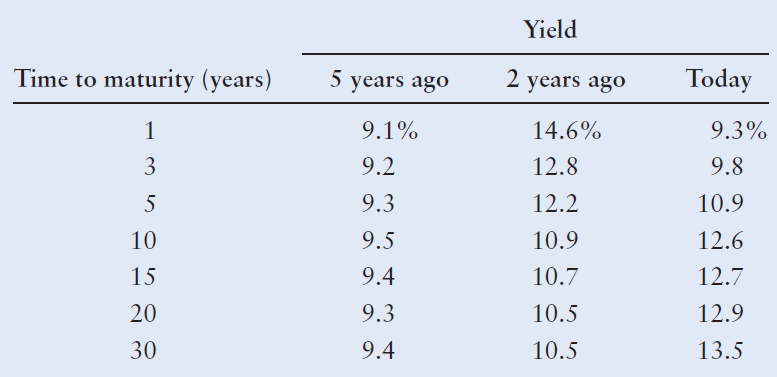

The following yield data for a number of highest-quality corporate bonds existed at each of the three points in time noted.

a. On the same set of axes, draw the yield curve at each of the three given times.

b. Label each curve in part a with its general shape (downward-sloping, upward-sloping, flat).

c. Describe the general interest rate expectation existing at each of the three times.

d. Examine the data from 5 years ago. According to the expectations theory, what approximate return did investors expect a 5-year bond to pay as of today?

Yield Today Time to maturity (years) years ago 2 years a 9.1% 9.2 9.3 9.5 9.4 9.3 9.4 14.6% 12.8 12.2 10.9 10.7 10.5 10.5 9.3% 9.8 10.9 12.6 12.7 12.9 13.5 1S 2 30

Step by Step Answer:

a b and c Five years ago the yield curve was relatively flat reflecting expectations of stable inter...View the full answer

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Related Video

Bond valuation is the process of determining the worth of a bond. It is based on the present value of the bond\'s future cash flows, which include coupon payments and the return of the bond\'s face value (or \"principal\") at maturity. The discount rate used in the calculation is directly tied to prevailing interest rates, and a rise in interest rates will decrease the present value of the bond and thus lower its price. Conversely, a fall in interest rates will increase the present value of the bond and raise its price. Interest rates serve as a benchmark for determining the value of a bond, as they determine the discount rate used in the bond valuation calculation. The most commonly used measure of interest rates is the yield to maturity (YTM), which represents the internal rate of return of an investment in a bond if the investor holds the bond until maturity and receives all scheduled payments. Yield to maturity is a function of the coupon rate, the current market price of the bond, the face value of the bond, and the number of years remaining until maturity. By comparing the yield to maturity of a bond to prevailing market interest rates, an investor can assess the relative value of the bond.

Students also viewed these Finance questions

-

A firm's cash flows are risky for a number of reasons. Identify and discuss five sources of risk or volatility in firm cash flows.

-

For a number of years, nearly all Americans say that they would vote for a woman for president IF she were qualified, and IF she were from their own political party. But is America ready for a female...

-

Data for a number of stock indices are provided on the authors Web site: www.rotman.utoronto.ca/ hull/data Choose an index and test whether a three standard deviation down movement happens more often...

-

Let U=(1,2,3,4,5,6,7,8,9,10,11,12,13,14), M=(2,4,5,6,7), and N={9,10,11,12,13,14,15). Find MON. MON (Use ascending order. Use a comma to separate answers as needed.) =

-

The adjusted trial balance for Fraser Valley Services Ltd. was prepared in E4-9. Data from E4-9. Instructions (a) Prepare the closing entries at August 31. (b) Prepare a post-closing trial balance....

-

Which operations decisions are most related to other managerial activities and which are purely operations management?

-

1. Explain how hiring decisions are affected by the Americans with Disabilities Act (ADA).

-

The following information is provided by Raynette's Pharmacy for the last quarter of its fiscal year ending on March 31, 20--: REQUIRED 1. Estimate the ending inventory as of March 31 using the...

-

EXERCISE 5-10 Compute the Break-Even Point for a Multiproduct Company (L09] Lucky Products markets two computer games: Predator and Runway. A contribution format income statement for a recent month...

-

Four years ago, Ideal Solutions issued convertible preferred stock with a par value of $50 and a stated dividend of 8 percent. Each share of preferred stock can be converted to four shares of common...

-

A firm wishing to evaluate interest rate behavior has gathered data on the nominal rate of interest and on inflationary expectations for five U.S. Treasury securities, each having a different...

-

The real rate of interest is currently 3%; the inflation expectation and risk premiums for a number of securities follow. a. Find the risk-free rate of interest, RF, that is applicable to each...

-

List the errors you find in the following statement of cash flows. The cash balance at the beginning of the year was $83,600. All other amounts are correct, except the cash balance at the end of...

-

1. A large group of students were asked what their favorite soft drink is. Below is the probability distribution for a student chosen at random liking a particular soft drink. Drink: Choka Kola CR...

-

Task: Identify a local (within 50km of North Bay) business and answer the following questions: Name of Business: 1. Is the business independent or is it a chain? What is one advantage of this...

-

What questions would you like to ask of Cassie to better understand any factors that may be affecting Sasha at this time? Growing sunflowers It's now week 6 into the growing sunflowers project. Your...

-

n rope is fixed to a wall and attached to the block such that the rope is parallel to the surface of the wedge. The 12 points) Consider the situation in the figure where a square block (mi) sits...

-

Discuss with fellow students your perceptions of your own job security or insecurity. What factors influence your assessment?

-

Can partitioned join be used for r r.A s? Explain your answer

-

Explain the CMMI model.

-

What is the general relationship between the theoretical and market values of a warrant? In what circumstances are these values quite close? What is a warrant premium?

-

What is the general relationship between the theoretical and market values of a warrant? In what circumstances are these values quite close? What is a warrant premium?

-

What is an option? Define calls and puts. What role, if any, do call and put options play in the fund-raising activities of the firm?

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

-

Regarding Enron, this was a company that resulted in the creation of the Sarbanes-Oxley Act and many reforms to the accounting profession. Research the company and answer the following...

Study smarter with the SolutionInn App