The frame- welding department of a large automotive company welds car frames as they pass down the

Question:

The frame- welding department of a large automotive company welds car frames as they pass down the assembly line. Four computer- controlled robots make the welds on each frame simultaneously. When installed last year, each robot was expected to have a five- year useful life before becoming obsolete and being replaced by newer, faster models with more advanced electronics. Over its life, each robot is expected to make 100 million welds. The robots cost $ 8 million apiece and have no salvage value at the end of their useful lives after the cost of dismantling and removing them is taken into consideration.

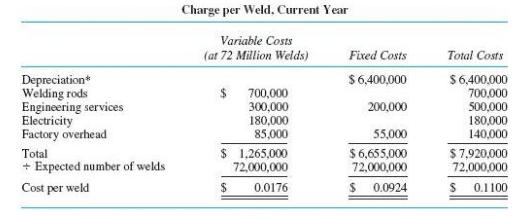

The firm has a traditional absorption costing system that costs each frame. The accounting sys-tem supports decision making and control. Straight- line depreciation is used for both internal and external reporting, and accelerated depreciation is used for taxes. As frames move through the welding stations, they are charged based on the number of welds made on each frame. Different car frames require different numbers of welds, with some frame models requiring up to 1,000 welds. Welds cost $ 0.11 each. This charge is set at the beginning of the year by estimating the fixed and variable costs in the welding department. Accounting determines the expected number of welds projected for the year by taking the projected number of frames times the number of welds per frame. The expected number of welds is used to estimate total costs in the welding department. The cost per weld is then the ratio of the projected welding costs to the expected number of welds. Seventy- two million welds were projected for the current year.

The following statement illustrates the computation of the charge per weld:

After reviewing the above statement, Amy Miller, manager of the body fabricating division (which includes the welding department), made the following remarks:

I know we use straight- line depreciation to calculate the depreciation component of the cost per weld now. But it would seem to make a lot of sense to compute robot depreciation us-ing units- of- production depreciation. Each robot cost $ 8 million and was expected to perform 100 million welds over its useful life. That comes to 8¢ per weld. Thus, we should charge each weld at 8¢ plus the remaining fixed and variable costs as calculated on this statement. If I back out the $ 6.4 million depreciation from the above figures and recompute the fixed costs per weld at 72 million welds, I get $ 255,000 divided by 72 million, or $ 0.00354. Add this to the variable cost per weld of $ 0.0176 plus the 8¢ depreciation and our cost per weld is $ 0.1011 per weld, not the 11¢ now. This reduces our costs on our complicated frames by as much as $ 10.

The real advantage of using units- of- production depreciation, in my opinion, is that depreciation becomes a variable cost. This has real advantages because, when you lower your fixed costs, your break- even point is lower. Operating leverage is lower, and thus the company’s overall risk is reduced.

I think we should go to the plant controller and see if we can convince him to use a more realistic basis for calculating the depreciation costs of the robots.

Required:

Do you agree with Amy Miller’s proposal?

Salvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Accounting for Decision Making and Control

ISBN: 978-0078025747

8th edition

Authors: Jerold Zimmerman