The general ledger of Val d'Or Corporation contains the following selected accounts and information: 1. Cash 2.

Question:

The general ledger of Val d'Or Corporation contains the following selected accounts and information:

1. Cash

2. Common shares

3. Other comprehensive income-Revaluation gain from revaluing property, plant, and equipment to fair value

4. Long-term investments

5. Preferred shares

6. Retained earnings

7. Gain on disposal

8. Cash dividends

9. Stock split

10. Stock dividends distributable

Instructions

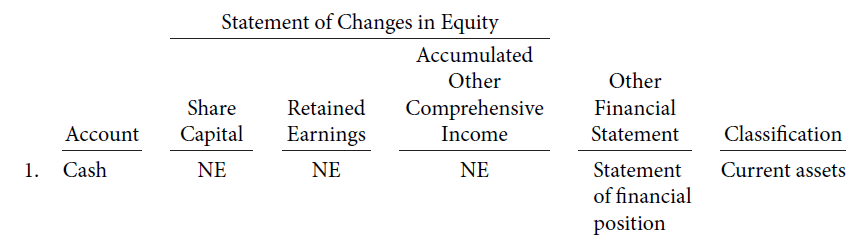

Indicate whether each of the above accounts should be reported in the statement of changes in equity. If yes, indicate whether the account should be reported in the share capital, retained earnings, or accumulated other comprehensive income section of the statement. If not, indicate in which financial statement (statement of financial position or income statement) and in which section the account should be reported or write NE (no effect), if the statement is not affected. The first account has been done for you as an example.

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Accounting Tools for Business Decision Making

ISBN: 978-1118644942

6th Canadian edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso, Barbara Trenholm, Wayne Irvine