The long-term debt working paper shown below was prepared by entity personnel and audited by Andy Fogelman,

Question:

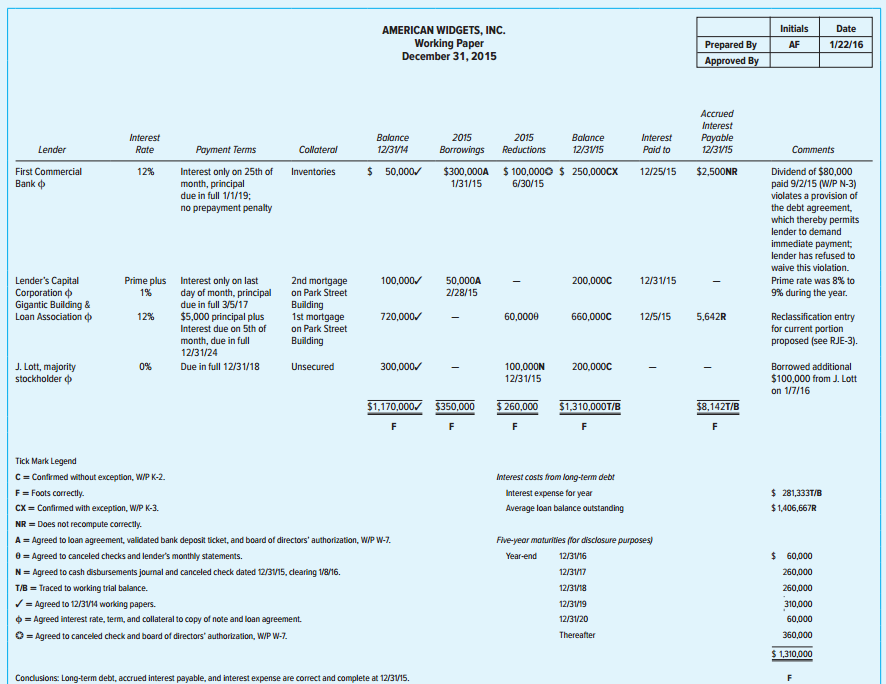

The long-term debt working paper shown below was prepared by entity personnel and audited by Andy Fogelman, an audit assistant, during the calendar year 2015audit of American Widgets, Inc., a continuing audit client. The engagement supervisor is reviewing the working paper thoroughly.

Required:

There are a number of deficiencies in the working paper. For example, the subject of the working paper is not properly indicated in the title and there is no indication that the unusually high average interest rate (20% = $281,333/$1,406,667) was noted or investigated. Identify at least five additional deficiencies that the engagement supervisor should discover.

AMERICAN WIDGETS, INC. Working Paper December 31, 2015 Initials Date 1/22/16 Prepared By AF Approved By Accrued Interest Interest Balance 2015 2015 Balance Interest Payable 12/31/15 Lender Payment Terms Borrowings 12/3/15 Paid to Rate Colateral 12/31/14 Reductions Comments $ 100,0000 $ 250,000CX $ 50,000/ $300,000A $2,500NR Dividend of $80,000 paid 9/2/15 (W/P N-3) violates a provision of the debt agreement, which thereby permits First Commercial 12% Interest only on 25th of month, principal due in full 1/1/19; no prepayment penalty Inventories 12/25/15 Bank ф 1/31/15 6/30/15 lender to demand immediate payment; lender has refused to waive this violation. Lender's Capital Corporation o Gigantic Building & Loan Association o Prime plus Interest only on last day of month, principal 2nd mortgage on Park Street Building 1st mortgage on Park Street Building 100,000/ 50,000A 2/28/15 200,000C 12/31/15 Prime rate was 8% to 9% during the year. 1% due in full 3/5/17 $5,000 principal plus 720,000/ 60,0000 660,000C 12/5/15 Reclassification entry for current portion proposed (see RJE-3). 12% 5,642R Interest due on 5th of month, due in full 12/31/24 J. Lott, majority stockholder o 0% Due in full 12/31/18 Unsecured 300,000/ 100,000N 200,000C Borrowed additional $100,000 from J. Lott 12/31/15 on 1/7/16 $1,170,000/ $350,000 $1,310,000T/B $ 260,000 $8,142T/B Tick Mark Legend C= Confirmed without exception, W/P K-2. Interest costs from long-term debt F= Foots correctly. CX = Confirmed with exception, W/P K-3. $ 281,333T/B Interest expense for year $1,406,667R Average loan balance outstanding NR = Does not recompute correctly. A = Agreed to loan agreement, validated bank deposit ticket, and board of directors' authorization, W/P W-7. Five-year maturities (or disclasure purposes) 0 = Agreed to canceled checks and lender's monthly statements. $ 60,000 Year-end 12/31/16 N= Agreed to cash disbursements journal and canceled check dated 12/3/15, clearing 1/8/16. 12/31/17 260,000 T/B = Traced to working trial balance. V= Agreed to 12/3V14 working papers. 260,000 12/31/18 310,000 12/31/19 0 = Agreed interest rate, term, and collateral to copy of note and loan agreement. O = Agreed to canceled check and board of directors' authorization, WP W-7. 12/31/20 60,000 Thereafter 360,000 $ 1,310,000 Conclusions: Long-term debt, accrued interest payable, and interest expense are correct and complete at 12/31/15.

Step by Step Answer:

The working paper contains the following deficiencies The subject of the working paper is not proper...View the full answer

Auditing and Assurance Services A Systematic Approach

ISBN: 978-0077732509

10th edition

Authors: William Messier Jr, Steven Glover, Douglas Prawitt

Students also viewed these Auditing questions

-

The long- term debt working paper on the next page was prepared by client personnel and audited by Andy Fogelman, an audit assistant, during the calendar year 2013 audit of American Widgets, Inc., a...

-

On January 2, 20X2, EL Limited established a subsidiary in Mexico City, Mexico. The subsidiary was named GC Company and the cost of ELs investment was C$ 500,000. When this investment was translated...

-

The long-term debt working paper in Exhibit DC14-5 was prepared by client personnel and audited by AA, an audit staff assistant, during the calendar year 20X2 audit of Canadian Widgets Inc., a...

-

Laura Leasing SA signs an agreement on January 1, 2022, to lease equipment to Plote AG. The following information relates to this agreement. 1. The term of the non-cancelable lease is 3 years with no...

-

In 1995, a working group of French chief executive officers was set up by the Confederation of French Industry (CNPF) and the French Association of Private Companies (APEP) to study the French...

-

Apex Chemicals Company acquires a delivery truck at a cost of $26,000 on depreciation. January 1, 2007. The truck is expected to have a salvage value of $4,000 at the end of its (SO 3) 5-year useful...

-

Pavin Stabler Investment in Pavin bonds. LO4 -0- 147,000 Land, buildings, and equipment (net). 245,000 541,000 Trademarks. -0- Total assets. .... $ 1,250,000 $ 810,000 Accounts payable. . . . . $...

-

It is the end of 2010, and, as an accountant for Newell Company, you are preparing its 2010 financial statements. On December 29, 2010, the management of Newell decided to sell one of its major...

-

11:04 Done Expert Q&A Trina's Software Mini-Case Trina is thinking of quitting her job as a software engineer (annual Salary of $75,000 per year) and starting her own programming service business....

-

A reversible heat / heat engine operates between two reservoirs at temperatures of 700 C and 50 C. This heat engine drives a refrigerator engine which operates between two reservoirs at temperatures...

-

Maslovskaya, CPA, has been engaged to examine the financial statements of Broadwall Corporation for the year ended December 31, 2015. During the year, Broadwall obtained a long-term loan from a local...

-

The following client-prepared bank reconciliation is being examined by Zachary Kallick, CPA, during the examination of the financial statements of Simmons Company. Required: Items (a) through (e)...

-

A random sample of 40 business majors who had just completed introductory courses in both statistics and accounting was asked to rate each class in terms of level of interest on a scale of 1 (very...

-

Given forecast errors of 4, 8, and -3, what is the MAD? What is the MSE?

-

Padgett Rentals can purchase a van that costs \($48,000\) ; it has an expected useful life of three years and no salvage value. Padgett uses straight-line depreciation. Expected revenue is...

-

Rainwater Corp. expects to sell 600 umbrellas in May and 400 in June. Each umbrella sells for \($15\). Rainwaters beginning and ending finished goods inventories for May are 75 and 50 units,...

-

Don Moon is the owner of ABC Cleaning. At the beginning of the year, Moon had \(\$ 2,400\) in inventory. During the year, Moon purchased inventory that cost \(\$ 13,000\). At the end of the year,...

-

Agua Ole is a distributor of bottled water. For each of items a through c, compute the amount of cash receipts or payments Agua Ol will budget for September. The solution to one item may depend on...

-

Consider an equimolar mixture of n-butane (1) + 1-butanol (2) at 50C. Calculate the second-virial coefficient of the mixture using Equation 12.24. Equation 12.24. |||| H=C=C=C=CH | - | n-butane...

-

Can partitioned join be used for r r.A s? Explain your answer

-

What steps should an auditor perform to identify the risk of material misstatement due to fraud?

-

Why would a company institute a control policy that required mandatory vacations?

-

Marv Jackal, CPA, determines that a number of risks of material misstatement are pervasive to the overall Financial statements. How should Jackal respond to such pervasive risks?

-

explain the concept of Time Value of Money and provide and example. In addition to your discussion, please explain the differences between Stocks and Bonds

-

Wildhorse Inc. has just paid a dividend of $3.80. An analyst forecasts annual dividend growth of 9 percent for the next five years; then dividends will decrease by 1 percent per year in perpetuity....

-

Jenny wanted to donate to her alma mater to set up a fund for student scholarships. If she would like to fund an annual scholarship in the amount of $6,000 and her donation can earn 5% interest per...

Study smarter with the SolutionInn App