The management of Revco Products is exploring four different investment opportunities. Information on the four projects under

Question:

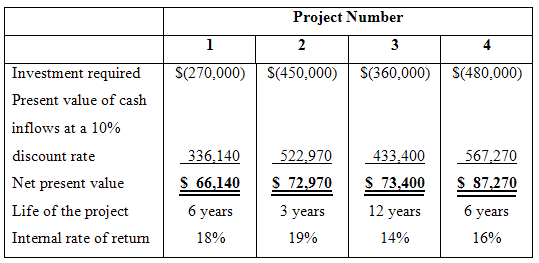

The management of Revco Products is exploring four different investment opportunities. Information on the four projects under study follows:

The company’s required rate of return is 10%; thus, a 10% discount rate has been used in the present value computations above. Limited funds are available for investment, so the company can’t accept all of the available projects.

Required:

1. Compute the project profitability index for each investment project.

2. Rank the four projects according to preference, in terms of:

(a) Net present value

(b) Project profitability index

(c) Internal rate of return

3. Which ranking do you prefer? Why?

Project Number 2 3 4 Investment required S(450,000)| S(360,000) S(480,000) S(270,000) Present value of cash inflows at a 10% 336,140 discount rate 522,970 433,400 567,270 $ 66,140 S 72,970 S 73,400 S 87,270 Net present value Life of the project 3 years 12 years 6 years 6 years Intemal rate of return 14% 18% 19% 16%

Step by Step Answer:

1 The formula for the project profitability index is The indexes for the projects under consideratio...View the full answer

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer

Related Video

NPV stands for \"Net Present Value,\" which is a financial concept used to determine the value of an investment or project. It measures the difference between the present value of cash inflows and the present value of cash outflows over a given period of time, using a specific discount rate. To calculate the NPV of an investment, you need to first estimate the cash inflows and outflows associated with the investment, and then discount them back to their present values using a discount rate. The discount rate represents the cost of capital or the expected rate of return required by investors. The formula for calculating NPV is: NPV = sum of (cash inflows / (1 + discount rate)^t) - sum of (cash outflows / (1 + discount rate)^t) Where: Cash inflows: the expected cash received from the investment Cash outflows: the expected cash paid out for the investment Discount rate: the required rate of return or the cost of capital t: the time period in which the cash flow occurs If the NPV is positive, it means that the investment is expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a good investment. If the NPV is negative, it means that the investment is not expected to generate a return higher than the required rate of return or the cost of capital, and it may be considered a bad investment.

Students also viewed these Managerial Accounting questions

-

The management of Revco Products is exploring five different investment opportunities. Information on the five projects under study follows: The company?s required rate of return is 10%; thus, a 10%...

-

The viscosity of oil after it has been used in an engine over a period of time may change from its initial value because the high temperature inside the engine can cause the oil to break down. An...

-

The randomized block design has been used in comparing the effectiveness of three treatments, with the data as shown in the table. Using the 0.05 level of significance, can we conclude that the...

-

Smart Price Company, a producer of black forest cakes, has budgeted sales and production (in units) for the last quarter in 2019 to be as follows: Sales Production October November 26,000 28,000...

-

Suppose that you make a large number of independent observations of a random variable and then construct a table giving the possible values of the random variable and the proportion of times each...

-

Several years ago, Minjun, who is single, acquired 1244 stock in Blue Corporation at a cost of $60,000. He sells the Blue stock for $5,000 in the current year. Determine the amount and nature of...

-

A company is considering an investment paying $10,000 every six months for three years. The first payment would be received in six months. If this company requires an 8% annual return, what is the...

-

Elina Siljander owns Elinas Stained Glass in Helsinki, Finland. The business produces and sells three different types of stained glass windows: small, medium, and large. Elina has two full-time...

-

5. Jerry bought a house for $650,000. He lived in it for two years and he decided to buy a new house to live in. Rather than sell the old house he rents out the house. At the time he rents out the...

-

Investing involves making informed decisions, which means researching companies and industries before plunking down your hard-earned money! An excellent source of information about a company is the...

-

Oxford Company has limited funds available for investment and must ration the funds among four competing projects. Selected information on the four projects follows: The net present value s above...

-

Windhoek Mines, Ltd., of Namibia, is contemplating the purchase of equipment to exploit a mineral deposit on land to which the company has mineral rights. An engineering and cost analysis has been...

-

In Exercises determine the convergence or divergence of the series. n=1 (-1)+(n+1) In(n + 1)

-

1. Define a person-centered model of care in LTC facilities. 2. Describe two leadership behaviors and two leadership qualities most conducive to moving long-term care organizations toward more...

-

question 5 all parts 8+0.5 = 4. Consider a system with a lead compensator Ge(s) = +0.13 followed by a plant G(s) = 10 Determine a value for a gain K on the error signal such that the phase margin...

-

3- Define and describe, in detail, the various communication styles as they relate to negotiation and conflict resolution. Compare the advantages and disadvantages of the styles. Provide a detailed...

-

SJ Corp ahs the following data for 2020: RM, beginning of 5,000; Purchases of raw materials is 50,000; return of defective raw materials to suppliers of 4,000; return of direct materials from the...

-

A company is issuing $340,000 worth of 4-year bonds on October 8, 2023, bearing an interest rate of 2%, payable annually. Assume that the current market rate of interest is 3%. a) Will the bonds be...

-

Which of the following statements is not correct? a. Lenders of growth capital depend on anticipated profitability for repayment over an extended period of time. b. Every business needs equity,...

-

Find the center of mass of a thin triangular plate bounded by the y-axis and the lines y = x and y = 2 - x if (x, y) = 6x + 3y + 3.

-

List the products of each alkene addition reaction. a. CH3 -CH=CH-CH3 + Cl b. CH3-CH-CH=CH-CH3 + HBr T CH3 c. CH3 -CH-CH=CH-CH3 + Br CH3 d. CH3 -CH-CH=C-CH3 + HCl T CH3

-

Two savings banks are located across the street from each other. The West Bank put a sign in the window saying, "We pay 6.50%, compounded daily." The East Bank put up a sign saying, "We pay 6.50%,...

-

Sally Struthers wants to have $10,000 in a savings account at the end of 6 months. The bank pays 8%, - compounded continuously. How much should Sally deposit now?

-

The I've Been Moved Corporation receives a constant flow of funds from its worldwide operations. This money (in the form of checks) is continuously deposited in many banks with the goal of earning as...

-

During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of goods sold totaled $7,140,000 (60% of sales). The company...

-

What is the value of a 15% coupon bond with 11% return? Is it a discount or a premium bond?

-

A manufacturer with a December 31 taxation year end sells new machinery for $50,000 on January 2, 2022. The cost of the machinery is $20,000. The terms of the sale require an initial payment of...

Study smarter with the SolutionInn App