The Marshall Company is a large manufacturer of office furniture. The company has recently adopted lean accounting

Question:

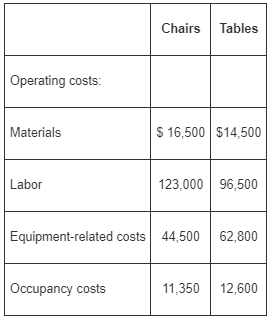

The Marshall Company is a large manufacturer of office furniture. The company has recently adopted lean accounting and has identified two value streams—office chairs and office tables. Total sales in the most recent period for the two streams are $245 and $310 million, respectively. In the most recent accounting period, Marshall had the following operating costs, which were traced to the two value streams as follows (in thousands).

| Non-traceable costs: | |||

| Manufacturing | $116,750,000 | ||

| SG&A | $25,000,000 | ||

| Fixed mfg. cost from prior-period inventory in the current I/S: | |||

| Office-chair value stream | $5,500,000 | ||

| Office-Table Value Stream | $22,500,000 | ||

| Sales revenue--most recent period: | |||

| Office-chair value stream | $245,000,000 | ||

| Office-Table Value Stream | $310,000,000 | ||

In addition to the traceable operating costs, the company had manufacturing costs of $116,750,000 and selling and administrative costs of $25 million that could not be traced to either value stream. Due to the implementation of lean methods, the firm has been able to reduce inventory in both value streams significantly and has calculated the fixed cost of prior period inventory that is included in the current income statement to be $5.5 million for the office chair stream and $22.5 million for the office table stream.

Required

Prepare the value stream income statement for MarshallCompany.

Step by Step Answer:

Cost management a strategic approach

ISBN: 978-0073526942

5th edition

Authors: Edward J. Blocher, David E. Stout, Gary Cokins