Question:

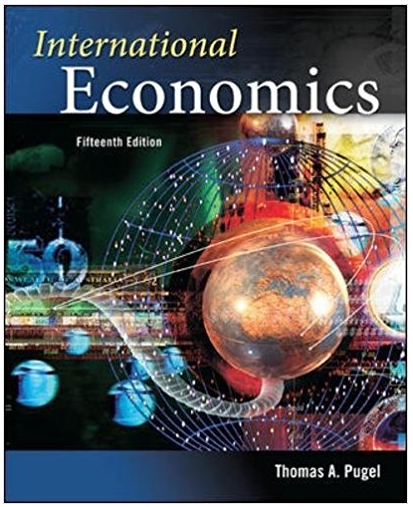

The "Optimal Deadbeat" Problem: The World Bank is considering a stream of loans to the Puglian government to help it develop its nationalized oil fields and refineries. This is the only set of loans that the World Bank would ever give Puglia. If Puglia defaults, it receives no further funds from this set of loans from the World Bank. Whether the Puglian government repays the loan or defaults has no other impact on Puglia. The table shows the stream of loans to Puglia, the principal repayments and interest payments for the loans, and the increase in oil-export profits from the projects financed by the loans. Would it ever be in Puglia's interest to default on the loans? If not, why not? If so, why and when?

.png)

Transcribed Image Text:

Loan Effects (S millions) Stock of Accumulated Interest Payments Profits orn on Borrowings at End of Year(at 8 percent)Export Sales World Bank Loans and Borrowings Extra Oil Year Repayments $200 (loan) 100 (loan) 50 (loan) $200 300 350 350 300 250 200 150 100 50 16 24 28 28 24 20 16 12 30 45 60 60 60 60 60 60 60 60 4 50 (repayment) 50 (repayment) 50 (repayment) 50 (repayment 50 (repayment) 50 (repayment) 50 (repayment) 6 4

.png)