The partnership of Jones, Keller, and Glade was created on January 2, 2011, with each of the

Question:

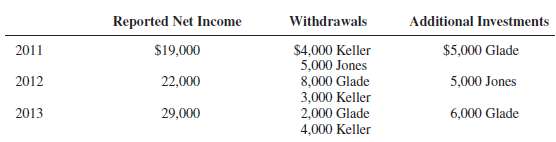

The partnership of Jones, Keller, and Glade was created on January 2, 2011, with each of the partners contributing cash of $30,000. Reported profits, withdrawals, and additional investments were as follows:

The partnership agreement provides that partners are to be allowed 10 percent interest on the beginning-of-the-year capital balances, that Jones is to receive a $7,000 salary allowance, and that remaining profits are to be divided equally.After the books were closed on December 31, 2013, it was discovered that depreciation had been understated by $2,000 each year and that the inventory taken at December 31, 2013, was understated by $8,000.REQUIRED1. Calculate the balances in the three capital accounts on January 1, 2014.2. Calculate the balances that should be in the three capital accounts on January 1, 2014, taking into account the corrections that must be made for errors made in the calculation of income in the prior years.3. Give the journal entry (one entry) to correct the books on January 1,2014.

PartnershipA legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith