Question: The post-closing trial balances of two proprietorships on January 1, 2010, are presented below. John and Calvin decide to form a partnership, John-Calvin Company, with

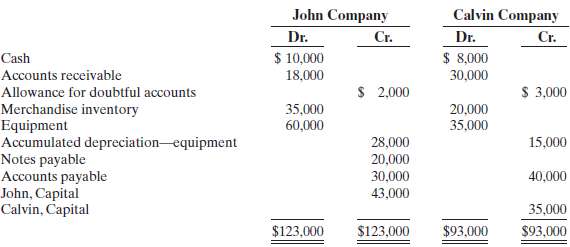

The post-closing trial balances of two proprietorships on January 1, 2010, are presented below.

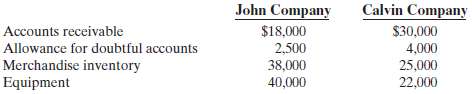

John and Calvin decide to form a partnership, John-Calvin Company, with the following agreed upon valuations for noncash assets.

All cash will be transferred to the partnership, and the partnership will assume all the liabilities of the two proprietorships. Further, it is agreed that John will invest an additional $3,500 in cash, and Calvin will invest an additional $16,000 in cash.Instructions(a) Prepare separate journal entries to record the transfer of each proprietorship's assets and liabilities to the partnership.(b) Journalize the additional cash investment by each partner.(c) Prepare a classified balance sheet for the partnership on January 1,2010.

John Company Calvin Company Dr. Cr. Dr. Cr. $ 10,000 18,000 $ 8,000 Cash Accounts receivable 30,000 $ 2,000 $ 3,000 Allowance for doubtful accounts Merchandise inventory Equipment Accumulated depreciation-equipment Notes payable Accounts payable John, Capital Calvin, Capital 35,000 60,000 20,000 35,000 28,000 15,000 20,000 30,000 40,000 43,000 35,000 $123,000 $123,000 $93,000 $93,000

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

a Jan 1 Cash 10000 Accounts Receivable 18000 Merchandise Inventory 38000 Equipment 40000 Allowance f... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-A-P (94).docx

120 KBs Word File