The shocks and struts division of Transnational Motors Company produces strut assemblies for automobiles. It has been

Question:

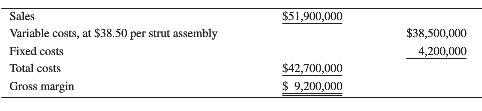

The shocks and struts division of Transnational Motors Company produces strut assemblies for automobiles. It has been the sole supplier of strut assemblies to the automotive division and charges $48 per unit, the current market price for very large wholesale lots. The shocks and struts division also sells to outside retail outlets, at $61 per unit. Normally, outside sales amount to 30% of a total sales volume of 1 million strut assemblies per year. Typical combined annual data for the division follow:

Flint Auto Parts Company, an entirely separate entity, has offered the automotive division comparable strut assemblies at a firm price of $42.70 per unit. The shocks and struts division of Transnational Motors claims that it cannot possibly match this price because it could not earn any margin at the price Flint is offering.

1. Assume that you are the manager of the automotive division of Transnational Motors. Comment on the shocks and struts division’s claim. Assume that normal outside volume cannot be increased.

2. Now assume the shocks and struts division believes that it can increase outside sales by 700,000 strut assemblies per year by increasing fixed costs by $2.5 million and variable costs by $4.50 per unit while reducing the selling price to $58. Assume that maximum capacity is 1 million strut assemblies per year. Should the division reject intra company business and concentrate solely on outside sales?

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta