The three partners of Hawkdale Contractors agree to liquidate their partnership on August 8, 2017. At that

Question:

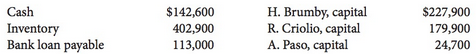

The three partners of Hawkdale Contractors agree to liquidate their partnership on August 8, 2017. At that point, the accounting records show the following balances:

The three partners share profit and loss equally.

Instructions

(a) Journalize the liquidation of the partnership on August 8 under each of the following independent assumptions:

1. The inventory is sold for $434,000 cash, the bank loan payable is paid, and the remaining cash is paid to the partners.

2. The inventory is sold for $318,000 cash and the bank loan payable is paid. Assume that any partners with a debit capital balance pay the amount owed to the partnership.

(b) Refer to item 2 above. Assume instead that any partners with a debit capital balance are unable to pay the amount owed to the partnership. Journalize the reallocation of the deficiency and final distribution of cash to the remaining partners.

TAKING IT FURTHER

What can partners do when a partnership is first created to reduce the possibility that one of the partners will have a deficit (debit balance) when the partnership is liquidated?

DistributionThe word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Liquidation

Liquidation in finance and economics is the process of bringing a business to an end and distributing its assets to claimants. It is an event that usually occurs when a company is insolvent, meaning it cannot pay its obligations when they are due.... Partnership

A legal form of business operation between two or more individuals who share management and profits. A Written agreement between two or more individuals who join as partners to form and carry on a for-profit business. Among other things, it states...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119048473

7th Canadian Edition Volume 2

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak