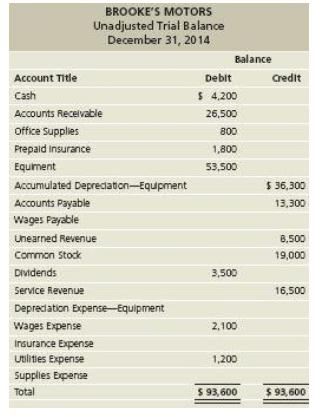

The unadjusted trial balance of and adjustment data of Brookes Motors at December 31, 2014, follow: Adjusting

Question:

The unadjusted trial balance of and adjustment data of Brooke’s Motors at December 31, 2014, follow:

Adjusting data at December 31, 2014:

a. Depreciation on equipment, $ 1,400.

b. Accrued Wages Expense, $ 500.

c. Office Supplies on hand, $ 400.

d. Prepaid Insurance expired during December, $ 300.

e. Unearned Revenue earned during December, $ 3,500.

f. Accrued Service Revenue, $ 900.

2015 transactions:

a. On January 4, Brooke’s Motors paid wages of $ 950. Of this, $ 500 related to the accrued wages recorded on December 31.

b. On January 10, Brooke’s Motors received $ 1,300 for Service Revenue. Of this, $ 900 related to the accrued Service Revenue recorded on December 31.

Requirements

1. Journalize adjusting journal entries.

2. Journalize reversing entries for the appropriate adjusting entries.

3. Refer to the 2015 data. Journalize the cash payment and the cash receipt that occurred in 2015.

Step by Step Answer:

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura