The unadjusted trial balance of Laundry Basket at January 31, 2012, the end of the current fiscal

Question:

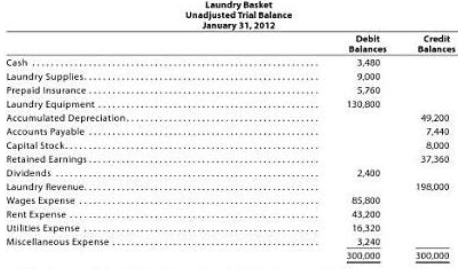

The unadjusted trial balance of Laundry Basket at January 31, 2012, the end of the current fiscal year, is shown below.

The data needed to determine year-end adjustments are as follows:

a. Wages accrued but not paid at January 31 are $900.

b. Depreciation of equipment during the year is $7,000.

c. Laundry supplies on hand at January 31 are $2,100.

d. Insurance premiums expired during the year are $4,000.

Instructions

1. For each account listed in the unadjusted trial balance, enter the balance in a T account. Identify the balance as “Jan, 31 Bal.” In addition, add T accounts for Wages Payable, Depreciation Expense, Laundry Supplies Expense, Insurance Expense, and Income Summary.

2. Optional: Enter the unadjusted trial balance on an end-of-period spreadsheet (work sheet) and complete the spreadsheet. Add the accounts listed in part (1) as needed.

3. Journalize and post the adjusting entries. Identify the adjustments by “Adj” and the new balance as “Adj. Bal”

4. Prepare an adjusted trial balance.

5. Prepare an income statement, a retained earnings statement, and a balance sheet.

6. Journalize and post the closing entries. Identify the closing entries by “Clos”

7. Prepared a post-closing trial balance.

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren