The unclassified statement of financial position accounts for Sorkin Corporation, which is a public company using IFRS,

Question:

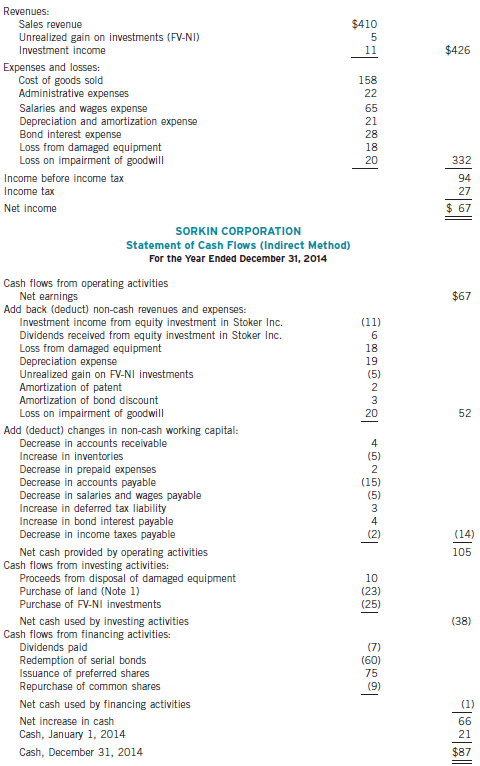

The unclassified statement of financial position accounts for Sorkin Corporation, which is a public company using IFRS, for the year ended December 31, 2013, and its statement of comprehensive income and statement of cash flows for the year ended December 31, 2014, are as follows:

SORKIN CORPORATION

Statement of Financial Position Accounts

December 31, 2013

($ in millions)

Cash…………………………………………………………………..$ 21

Accounts receivable…………………………………………………..194

Inventory……………………………………………………………..200

Prepaid expenses………………………………………………………12

Long-term investment in shares of Stoker Inc……………………….125

Land………………………………………………………………….150

Buildings and equipment…………………………………………….400

Accumulated depreciation…………………………………………..(120)

Patents………………………………………………………………...60

Accumulated amortization patent……………………………………(28)

Goodwill……………………………………………………………...60

Total assets……………………………………………………….$1,074

Accounts payable…………………………………………………...$ 65

Salaries and wages payable…………………………………………...11

Bond interest payable………………………………………………… 4

Income tax payable………………………………………………….. 14

Deferred tax liability…………………………………………………. 8

Bonds payable………………………………………………………250

Common shares……………………………………………………. 495

Retained earnings………………………………………………….. 227

Total liabilities and shareholders’ equity………………………..$1,074

SORKIN CORPORATION

Statement of Income

Year Ended December 31, 2014

($ in millions)

Note 1. Non-cash investing and financing activities

(a) During the year, land was acquired for $46 million in exchange for cash of $23 million and a $23-million, four-year, 15% note payable to the seller.

(b) Equipment was acquired through a finance lease that was capitalized initially at $82 million.

Additional information:

1. The investment income represents Sorkin's reported income in its 35%-owned, significantly influenced investment in Stoker Inc. Sorkin received a dividend from Stoker during the year.

2. Early in 2014, Sorkin purchased shares for $25 million as an investment at fair value with gains and losses in net income. There were no purchases or sales of these shares during 2014, nor were there any dividends received from this investment.

3. A machine that originally cost $70 million became unusable due to a flood. Most major components of the machine were unharmed and were sold together for $10 million. Sorkin had no insurance coverage for the loss because its insurance policy did not cover floods.

4. Reversing differences in the year between pre-tax accounting income and taxable income resulted in an increase in future taxable amounts, causing the deferred tax liability to increase by $3 million.

5. On December 30, 2014, land costing $46 million was acquired by paying $23 million cash and issuing a $23-million, four-year, 15% note payable to the seller.

6. Equipment was acquired through a 15-year financing lease. The present value of minimum lease payments was $82 million when signing the lease on December 31, 2014. Sorkin made the initial lease payment of $2 million on January 1, 2015.

7. Serial bonds with a face value of $60 million were retired at maturity on June 20, 2014. In order to finance this redemption and have additional cash available for operations, Sorkin issued preferred shares for $75 million cash.

8. In February, Sorkin issued a 4% stock dividend (4 million shares). The market price of the common shares was $7.50 per share at that time.

9. In April 2014, 1 million common shares were repurchased for $9 million. The weighted average original issue price of the repurchased shares was $12 million.

Instructions

(a) Prepare the unclassified statement of financial position accounts for Sorkin Corporation for the year ended December 31, 2014, as a check on the statement of cash flows. Add whichever accounts you consider necessary.

(b) Prepare the operating activities section of the statement of cash flows for Sorkin Corporation using the direct method.

(c) How would the statement of cash flows differ if the terms on the purchase of land had been essentially the same except that the financing for the note payable had been negotiated with a mortgage company instead of the seller of the land?

Face ValueFace value is a financial term used to describe the nominal or dollar value of a security, as stated by its issuer. For stocks, the face value is the original cost of the stock, as listed on the certificate. For bonds, it is the amount paid to the... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-1118300855

10th Canadian Edition Volume 2

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy