The wauditor is to presume that there is fraud in revenue. Consider a company that manufactures high-tech

Question:

The wauditor is to presume that there is fraud in revenue. Consider a company that manufactures high-tech fiber-optic gear. Assume that the Wall Street analysts believe the industry has good growth prospects. The audit client is predicting a 20% increase in sales and a 27% increase in profits for the year under audit. The auditor is planning the audit and knows the following:

• 65% of all sales are made to just five customers.

• There are three companies with very similar products. One has a moderately larger market share and the other has a significantly smaller market share.

• There are indications that the economy is slowing down and it is expected that a slowdown would affect the market for high-tech products that the company sells.

Required

a. Indicate the types of analytical analysis of the company’s preliminary financial results that the auditor should perform to facilitate the “brainstorming” and planning of the audit. In your answer, identify key factors that would indicate higher fraud risk. Organize your answer as follows:

Analytical Analysis Indicators of High Fraud Risk

Example: Analysis of revenue recorded

by quarter and increases near the

end of the quarter or year end.

b. What additional information should the auditor gather about the strength of the industry in which the client operates?

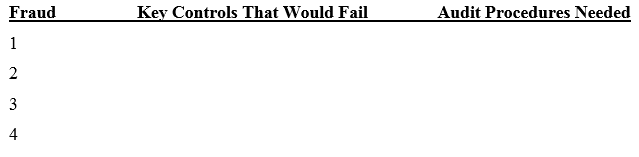

c. Identify four ways in which the client might overstate revenue. For each approach identified, indicate (i) internal control procedures that would have to fail for the fraud to take place; and (ii) audit procedures to test for the potential revenue overstatement. Organize your answer as follows:

Step by Step Answer:

Auditing a business risk appraoch

ISBN: 978-0324375589

6th Edition

Authors: larry e. rittenberg, bradley j. schwieger, karla m. johnston