The weighted average cost of capital is the weighted average rate for the costs of the various

Question:

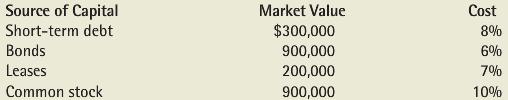

The weighted average cost of capital is the weighted average rate for the costs of the various sources of financing in an organization. These sources for Tudor Industries are as follows:

The short-term debt represents revolving credit, which is periodically renewed. Income taxes average 25%.

REQUIRED

A. Calculate the weighted average cost of capital (WACC) for Tudor Industries. If you need a formula, use a finance textbook or conduct an Internet search for “weighted average cost of capital.” One Web site providing a formula is: www.investopedia.com/terms/w/wacc.asp.

B. Explain how and why income taxes affect the calculation of WACC.

C. Discuss uncertainties about the best measure to use for the discount rate in a capital budgeting problem.

D. Discuss the pros and cons of using WACC as a discount rate in capital budgeting.

E. The market value for each source of capital is used when calculating WACC. Suppose you work for Tudor and need to calculate its WACC, but you do not know the market values.

Describe possible ways that you could estimate the market value for each of Tudor’s sources of capital.

F. Some people use financial statement book values to calculate WACC. Discuss reasons why this approach might result in an inappropriate value for WACC.

Capital BudgetingCapital budgeting is a practice or method of analyzing investment decisions in capital expenditure, which is incurred at a point of time but benefits are yielded in future usually after one year or more, and incurred to obtain or improve the... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Discount Rate

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal...

Step by Step Answer:

Cost Management Measuring Monitoring And Motivating Performance

ISBN: 392

2nd Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott