This continues the Fitness Equipment Doctor, Inc., example from the Continuing Problem in Chapter 8. Fitness Equipment

Question:

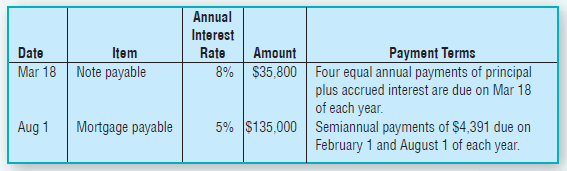

This continues the Fitness Equipment Doctor, Inc., example from the Continuing Problem in Chapter 8. Fitness Equipment Doctor, Inc., purchased some of its long-term assets during 2016 using long-term debt. The following table summarizes the nature of this long-term debt. Assume the fiscal year ends on December 31.

Requirements

1. Calculate the interest expense that Fitness Equipment Doctor, Inc., should accrue as of December 31, 2016. Round your answer to the nearest dollar. Use 365 days for the note payable (ignore leap year).

2. Prepare the balance sheet presentation at December 31, 2016, for all long-term debt indicating the portion that should be classified as current and the portion that should be classified as long-term?

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: