Question: Three mutually exclusive alternatives are being considered: At the end of its useful life, an alternative is not replaced. If the MARR is 10%, which

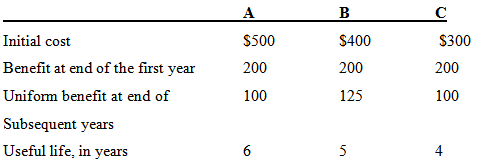

Three mutually exclusive alternatives are being considered:

At the end of its useful life, an alternative is not replaced. If the MARR is 10%, which alternative should be selected:

(a) Based on the payback period?

(b) Based on benefit-cost ratio analysis?

A Initial cost $500 $400 $300 Benefit at end of the first year Uniform benefit at end of 200 200 200 125 100 100 Subsequent years Useful life, in years 4

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

a Payback A 4 years Payback B 26 years Payback C 2 ye... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (261).docx

120 KBs Word File