To increase its share of the checking account market, Columbia City Bank in Seattle took two actions:

Question:

To increase its share of the checking account market, Columbia City Bank in Seattle took two actions: It established a customer call center to respond to customer inquiries about account balances, checks cleared, fees charged, etc. Columbia paid year-end bonuses to branch managers who met their branch’s target increase in the number of customers. While 80% of the branch managers met the target increase in the number of customers, Columbia City Bank’s profits continued to decline. John Diamond, the CEO, didn’t understand why profits were declining even though the bank was serving more customers. The Pierce County branch manager, Rose Perez, noticed that while small retail customers flocked to the bank, the number of business customers was declining.

Columbia City Bank’s costing system, developed back in 1988, is straightforward. No costs are traced directly to customers. The bank simply assigns the total indirect costs to customer lines (retail customer line or business customer line) based on the total number of checks processed.

Perez suspected that Columbia City Bank’s cost system might be part of the problem. Perez learned about ABC in school, but the applications involved manufacturing firms. She wonders whether Columbia City Bank could develop an ABC system, with the customer line as the primary cost object. Rose’s boss was skeptical. (“Our profits are going down the tubes and you want me to spend money developing a new accounting system?”) However, Rose persuaded her boss to allow a pilot ABC study, using the three Tacoma branches for the pilot test.

The ABC implementation team included Perez, the managers of each of the three Tacoma branches, a bank teller, and a customer service representative from the customer call center. The team began by identifying the following three activities:

● Check payments

● Teller withdrawals and deposits

● Customer service call center

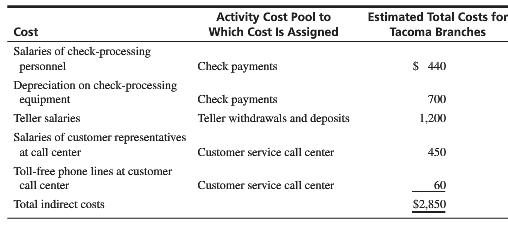

The ABC team then scrutinized the Tacoma branches’ total indirect cost of $2,850,000. They classified the components of this total indirect cost into the appropriate activity pool, coming up with the following estimates (in thousands of dollars):

The team then identified the following cost drivers for each activity cost pool:

Activity Cost Pool …………………………… Activity Cost Driver

Check payments ……………………. number of checks processed

Teller withdrawals and deposits ……. number of teller transactions

Customer service call center ……………………… number of calls

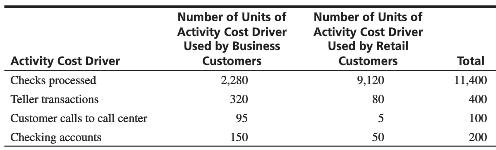

The ABC team estimated that for the Tacoma branches, the retail customer line and the business customer line would require the following total resources (in thousands):

That is, the retail customers have 320,000 teller transactions, make 95,000 calls to the customer service center, and so on.

On average, Columbia City Bank earns revenue from each type of account (from interest earned on checking account balances) as follows:

Average revenue per retail customer account $10

Average revenue per business customer account $40

1. Using the original (old) cost system complete the following:

a. Compute the indirect cost allocation rate.

b. Determine the total indirect cost assigned to the retail customer line and the business customer line.

c. Compute the proportion of the total indirect cost assigned to the retail customer line and the business customer line.

d. Determine the indirect cost per retail account and the indirect cost per business account.

e. Assuming that there are no direct costs, compute the average profit per account for retail customers and for business customers.

f. Assess the likely business strategy that might be adopted by managers using data from this original cost system.

2. What are the signs that Columbia City Bank’s original cost system was broken or in need of refinement?

3. Using the new activity-based costing system complete the following:

a. Compute the indirect cost allocation rates for each of the three activities:

● Check payments

● Teller withdrawals and deposits

● Customer call center

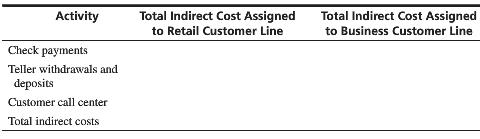

b. Use the following schedule to compute the total indirect cost allocated to each customer line:

c. What proportion of each activity’s resources is used by the retail customer line and the business customer line?

d. Using the ABC data from requirement 3b, compute the indirect cost per retail customer account and the indirect cost per business customer account.

e. Explain why the results in requirement 1d and requirement 3d differ. Be precise and specific.

f. Using the new ABC data, compute the average profit per account for both retail and business customers. Assess the likely business strategy that might be adopted by managers using data from this ABC cost system.

4. Be prepared to discuss the following questions:

a. Was Columbia City Bank’s bonus-based incentive plan to increase the number of checking account customers a wise strategy? Would you suggest any change in the strategy based on the ABC analysis?

b. What benefits can Columbia City Bank reap from the ABC analysis?

c. Why might Rose Perez have suspected that the benefits of ABC would likely outweigh the costs of implementing ABC at Columbia City Bank?

d. Why is it important for nonaccounting managers to understand ABC?

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta