Question: Tom Brown, controller of Microbiology Labs, informs you that the company has sold a segment of its business. Mr. Brown also provides you with the

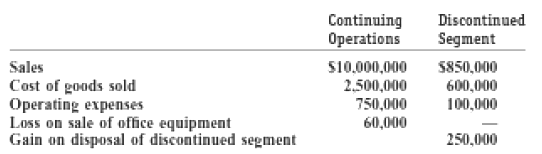

Tom Brown, controller of Microbiology Labs, informs you that the company has sold a segment of its business. Mr. Brown also provides you with the following information for 2012:

The following information is not reflected in any of the above amounts:

1. Microbiology Labs is subject to a 35 percent tax rate.

2. During 2012, Microbiology Labs retired outstanding bonds that were to mature in 2012. The company incurred a loss of $80,000, prior to taxes, on the retirement of the bonds.

3. Microbiology Labs owns several apple orchards part of its operations. During 2012, the company's apple crop was destroyed by an infestation of a rare insect. This unusual and infrequent loss, prior to taxes, totaled $800,000.

4. two million shares of common stock were outstanding throughout 2012.

Required

Prepare an income statement for the year ended December 31, 2012, including the recommended earnings-per-share disclosures. In terms of the objective of financial accounting comment on the usefulness of each of the different measures of income.

Continuing Operations Discontinued Segment S10,000,000 2,500,000 750,000 60,000 Sales Cost of goods sold Operating expenses Loss on sale of office equipment Gain on disposal of discontinued segment S850,000 100,000 250,000

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Microbiology Labs Income Statement For the Year Ended December 31 2012 Sales revenue 10000000 Cost of goods sold 2500000 Gross profit 7500000 Operatin... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

61-B-M-A-S-C-F (133).docx

120 KBs Word File