Tony Kasabian was ready to put the finishing touches on a business plan he wanted to present

Question:

Tony Kasabian was ready to put the finishing touches on a business plan he wanted to present to a local banker for financing for his new venture, Quick Photo Ltd. The investment proposal contained a marketing plan designed to capture a good share of the southern Ontario digital print market. Tony was interested in buying several new high-technology digital film printers manufactured in Japan and capable of providing online photo finishing and processing of top-quality prints from digital camera cards and CDs. His retailing plan consisted of operating digital print processors in kiosks in several Ontario high-traffic malls, including locations in Don Mills, Ottawa, Windsor, London, and Kingston. He felt that his business concept was in line with the trend of developing high-quality photo finishing services.

However, he realized that his banker would be asking him many questions about market size, his competitors, his revenue targets for the next several years, and, most important, his marketing assumptions backing up his sales forecast. Therefore, before finalizing his business plan, Tony asked his friend, a recent commerce graduate, to help him calculate the number of prints that he would have to process each year to cover his fixed costs and earn a reasonable profit.

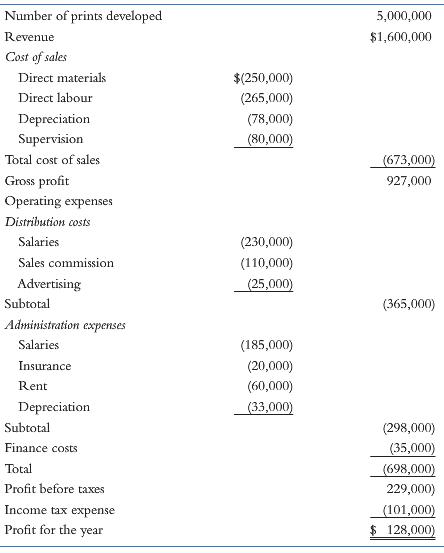

On average, Tony figured out that he would charge $0.32 per print, a price consistent with competitors’ charges for work of similar quality; most prints would be 4 × 6 and some would be 5 × 7 or 8 × 10. Quick Photo’s projected statement of income for the first year of operations is as follows.

1. Calculate Tony’s break-even point in revenue and the cash break-even point in revenue.

2. How many prints a year and what level of revenue must Tony reach if he wants to earn $275,000 in profit before taxes?

3. Calculate Tony’s annual revenue break-even point by using the PV ratio if he is to meet the $275,000 profit before tax goal.

4. If he increases his advertising budget by $20,000, what would be Tony’s new yearly break-even point in prints and in revenue? How many additional prints must Tony develop to increase his revenue to cover the incremental advertising budget?

5. If Tony reduces his direct material costs for processing the prints by $25,000, what would be his new break-even point in units and in revenue?

Step by Step Answer: