Two income statements for Bradford Company are shown below. a. Prepare a vertical analysis of Bradford Companys

Question:

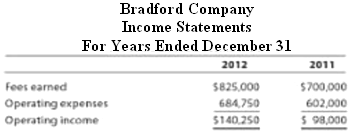

Two income statements for Bradford Company are shown below.

a. Prepare a vertical analysis of Bradford Company’s income statements.

b. Does the vertical analysis indicate a favorable or unfavorable trend?

Transcribed Image Text:

Bradford Company Income Statements For Years Ended December 31 2012 2011 Fees earned Operating expenses Operating income $825,000 $700,000 602,000 684,750 $140.250 $ 98,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 57% (14 reviews)

a Bradford Company Income Statements For Years Ended December 31 20...View the full answer

Answered By

FREDRICK MUSYOKI

Professional Qualities:

Solution-oriented.

Self-motivated.

Excellent problem-solving and critical thinking skills.

Good organization, time management and prioritization.

Efficient troubleshooting abilities.

Tutoring Qualities:

I appreciate students as individuals.

I am used to tailoring resources for individual needs.

I can integrate IT into student's lessons.

I am good at explaining concepts.

I am able to help students progress.

I have a wide curriculum knowledge.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Question Posted:

Students also viewed these Accounting questions

-

Two income statements for Fortson Company are shown below. a. Prepare a vertical analysis of Fortson Companys income statements. b. Does the vertical analysis indicate a favorable or...

-

Two income statements for Hitt Company are shown below. Prepare a horizontal analysis of Hitt Companys incomestatements. Hitt Company Income Statements For Years Ended December 31 Fees earned...

-

Two income statements for Boyer Company are shown on the following. Boyer Company Income Statements For Years Ended December 31 2012 2011 Fees earned Operating expenses Net income $300,000 $315,000...

-

Describe the Economic Analysis of the Valero Energy Corporation. Demonstrate Valero Energy Corporation is susceptible to Macroeconomic outlook both in the U.S.& foreign markets

-

Review the opening account balances in Winters Company's general and subsidiary ledgers on January 1, 2017. All accounts have normal debit and credit balances. Winters uses a perpetual inventory...

-

Assume that it is January 1, 2019, and that the Mendoza Company is considering the replacement of a machine that has been used for the past 3 years in a special project for the company. This project...

-

1 Why is the pacing of business negotiations faster in the United States than in India? What cultural factors are involved?

-

Macro Media, LLC, has three members: WLKT Partners, Amanda Nelson, and Daily Sentinel Newspaper, LLC. On January 1, 2012, the three members had equity of $250,000, $50,000, and $140,000,...

-

Garlic, an individual, is a limited partner in Onion Partnership. This year, Garlic's share of partnership ordinary income is $20,000, and she received a cash distribution of $30,000. Garlic's tax...

-

A. Does incompetence by top management and corporate boards of directors invalidate the value-maximization theory of the firm? B. Many shareholder groups prefer to split the chairman and CEO posts,...

-

Two income statements for Newman Company are shown below. a. Prepare a vertical analysis of Newman Companys income statements. b. Does the vertical analysis indicate a favorable or unfavorable trend?...

-

Classify the following items as (a) Prepaid expense, (b) Unearned revenue, (c) Accrued revenue, or (d) Accrued expense. 1. A three-year premium paid on a fire insurance policy. 2. Fees earned but not...

-

Write each percent as a fraction. Give answers in lowest terms. 180%

-

Revenue and cash receipts journals; accounts receivable subsidiary and general ledgers Transactions related to revenue and cash receipts completed by Crowne Business Services Co. during the period...

-

Panguitch Company had sales for the year of $100,000. Expenses (except for income taxes) for the year totaled $80,000. Of this $80,000 in expenses, $10,000 is bad debt expense. The tax rules...

-

Assume that the composition of federal outlays and receipts shown in the figure remained the same in 2019. In the figure, the categories "Defense and homeland security" and "Non-defense...

-

1) A car's age is a _ variable. Quantitative O Categorical 2) A car's maker is a variable O Quantitative Categorical 3) A house's square footage is a _________variable O Quantitative O Categorical 4)...

-

The following table shows the distribution of clients by age limits. Use the grouped data formulas to calculate the variance and standard deviation of the ages. Rango de edad Cantidad de clientes...

-

Compute labor efficiency and labor rate variances; record variances. (Objs. 5,6). The standard cost sheet calls for I hour and 45 minutes of labor in the Assembly Department for each boom box...

-

To balance the chemical equation SiH3 + O2 SiO2 + HO, you could introduce coefficients a, b, c, d and write aSiH3 + bO2 cSiO + dHO then write linear equations for each element. The equation for Si...

-

Explain how collateral risk and counterparty risk can change over the life of a repurchase agreement.

-

Pier 1 imports reported cost of sales of $957 million for fiscal 2008. Inventory decreased during the year from $412 million to 316 million, and accounts payable (related to inventory purchases)...

-

The following information was taken from the 2008 statements of cash flow for Agilent Technologies and Advanced Micro Devices (dollars in millions): (a) Compute the change in cash for both...

-

The statement of cash flow for Nestle Group, a Swiss-based food conglomerate that publishes IFRS-based financial statements, contained the following numbers (in million Swiss francs-CHF). (a) Explain...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App