Question: Use the following end-of-year price data to answer the following questions for the Barris and Carson Companies. a. Compute the annual rates of return for

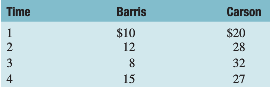

Use the following end-of-year price data to answer the following questions for the Barris and Carson Companies.

a. Compute the annual rates of return for each time period and for both firms.

b. Calculate both the arithmetic and geometric mean rates of return for the entire three-year period using your annual rates of return from part a. Note: You may assume that neither firm pays any dividends.

c. Compute a three-year rate of return spanning the entire period (i.e., using the beginning price for Period 1 and ending price for Period 4).

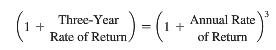

d. Because the rate of return calculated in part c is a three-year rate of return, convert it to an annual rate of return by using the following equation:

e. How is the annual rate of return calculated in part d related to the geometric rate of return? When you are evaluating the performance of an investment that has been held for several years, what type of average rate of return should you use (arithmetic or geometric)?Why?

Time Barris Carson $10 $20 12 8. 15 3 32 27

Step by Step Solution

3.42 Rating (168 Votes )

There are 3 Steps involved in it

A and B Here are the annual rates of return and the arithmetic and geometric averages for Barris Here are the comparable results for Carson C If we wi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

344-B-F-F-M (4875).docx

120 KBs Word File