Using the ARR method to make capital investment decisions Refer to the Smith Valley Snow Park Lodge

Question:

Using the ARR method to make capital investment decisions Refer to the Smith Valley Snow Park Lodge expansion project in Short Exercise S26- 4. Calculate the ARR. Round to two decimal places.

Data from Exercise S26-4

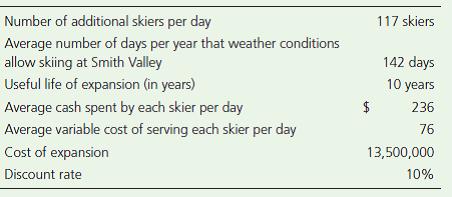

Consider how Smith Valley Snow Park Lodge could use capital budgeting to decide whether the $13,500,000 Snow Park Lodge expansion would be a good investment. Assume Smith Valley’s managers developed the following estimates concerning the expansion:

Assume that Smith Valley uses the straight-line depreciation method and expects the lodge expansion to have a residual value of $1,000,000 at the end of its 10-year life.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Horngrens Financial and Managerial Accounting

ISBN: 978-0133255584

4th Edition

Authors: Tracie L. Nobles, Brenda L. Mattison, Ella Mae Matsumura

Question Posted: