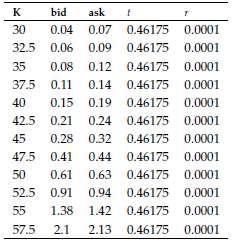

Using the Hirsa-Madan model proposed in Section 23.4.4 to calibrate the following table of out-of-the-money WMT put

Question:

bid askf 30 0.04 0.07 0.46175 0.0001 32.5 0.06 0.09 0.46175 0.0001 35 0.08 0.12 0.46175 0.0001 37.5 0.11 0.14 0.46175 0.0001 40 0.15 0.19 0.46175 0.0001 42.5 0.21 0.24 0.46175 0.0001 45 0.28 0.32 0.46175 0.0001 47.5 0.41 044 0.46175 0.0001 50 0.61 0.63 0.46175 0.0001 52.5 0.91 0.94 0.46175 0.0001 55 1.38 142 0.46175 0.0001 57.5 2.1 2.13 0.46175 0.0001

Step by Step Answer:

The following code can be used to apply the HirsaMadan model to calibrate the options above This led ...View the full answer

An Introduction to the Mathematics of Financial Derivatives

ISBN: 978-0123846822

3rd edition

Authors: Ali Hirsa, Salih N. Neftci

Related Video

A put option is a financial contract that gives the owner the right, but not the obligation, to sell an underlying asset, such as a stock or a commodity, at a predetermined price, known as the strike price, on or before a specific date, known as the expiration date. Put options are used by investors as a form of insurance against a decline in the value of the underlying asset. If an investor expects the value of an asset to fall in the future, they can purchase a put option on that asset. If the value of the asset does fall, the put option will increase in value, allowing the investor to sell the asset at the higher strike price. For example, if an investor owns 100 shares of a stock that is currently trading at $50 per share, they may purchase a put option with a strike price of $45 and an expiration date three months in the future. If the stock price falls to $40 before the expiration date, the investor can exercise the put option and sell their shares for $45 each, even though the market price is only $40. This would allow the investor to limit their losses. It\'s important to note that purchasing a put option involves paying a premium to the seller of the option, and the investor can lose the entire premium if the price of the underlying asset does not decline as expected. Put options are just one type of financial derivative and should only be used by experienced investors who understand the risks involved.

Students also viewed these Finance questions

-

Revisit the SETAR model for the 3-month Treasury Bills in Section 16.2.1 using the updated time series from Exercise 2. Does the SETAR model proposed in Section 16.2.1 hold? Change the value of the...

-

Revisit the LSTAR model for U.S. industrial production in Section 16.2.2 usini! the updated time series from Exercise 2. Find the best linear model, implement a linearity test, and if linearity is...

-

The following table shows some financial data for two companies: A B Total Asset $1,552.10 $1,565.70 EBITDA -60 70 Net Income + interest -80 24 Total Liabilities 814 1537.10 1. Calculate which has...

-

1. Internal controls are concerned with A) only manual systems of accounting. B) the extent of government regulations. safeguarding assets. C) D) preparing income tax returns. 2. Having one person...

-

Suppose that you are president of a newly established local union about to bargain with an employer for the first time. List the basic areas you want covered in the work agreement. Why might you...

-

How might the information required for control systems be collected?LO4

-

What is the decision facing Alibaba? When youre already big it can be hard to get bigger. Thats why Alibaba is working hard to continue to expand its e-tailing empire. In 1999, Jack Ma, inspired by a...

-

Global Green Books Publishing produces customized eBooks for a local college. It has just received an order for a new eBook on Strategic Human Resource Management in a Global Context from a senior...

-

Situation Ah Lee, a financial manager at a US based mid-sized manufacturing firm, has been caught off-guard before. In an effort to earn the most on excess cash, Ah Lee once bought five-year US...

-

This diagram shows memory configuration under dynamic partitioning after several placements and swapping-out operations have been carried out. Addresses go from left to right; gray areas indicate...

-

In Example 7 find the breakeven spread that is the spread that makes present value of the fixed leg the same of present value of the contingent leg.

-

Consider a first-to-default basket (FTD) that pays (1 R) upon the default of the first credit in a basket of 3 credits. Protection on the FTD lasts 5 years and payments are made quarterly. The...

-

Marpor Industries has no debt and expects to generate free cash flows of $16 million each year. Marpor believes that if it permanently increases its level of debt to $40 million, the risk of...

-

Name and define the more common constraints in any given project.

-

Graph the function f(x)=-x+4x-20 State where f(x) is increasing and decreasing. State any absolute extrema (if they exist). Determine the Domain and Range.

-

A residential wiring circuit is shown in the figure. In thismodel, the resistor R 3 is used to model a 250 V appliance(such as an electric range), and the resistors R 1 and R 2 are used to model 125...

-

1. The speed limit on some interstate highways is roughly 100 km/h. (a) What is this in meters per second? (b) How many miles per hour is this? 2. A car is traveling at a speed of 33 m/s. (a) What is...

-

Questions 33 and 34 are based on the following information: Bilog Company's budgeted fixed overhead costs are P50,000 and mthe variable factory overhead rate is P4 per direct labor hour. The standard...

-

Hydrofluoric acid, HF, is used in the manufacture of silicon computer chips. If the pH of a 0.139 M solution is 2.00, what is the ionization constant of the acid?

-

General Electric Capital, a division of General Electric, uses long-term debt extensively. In a recent year, GE Capital issued $11 billion in long-term debt to investors, then within days filed legal...

-

Consider a machine that fills soda bottles. The process has a mean of 15.9 ounces and a standard deviation of 0.06 ounces. The specification limits are set between 15.8 and 16.2 ounces. a) Compute...

-

Maryland Technical Acumen (MTA) is considering a new product line which will require an investment in production equipment and facilities in the current year. Below is an Income and cash flow...

-

(a) Find the amplitude, period, and phase shift of y = 3sin[(x 1/3)] (b) A ladder leans against a verfical wall of a building so that the angle between the ground and the ladder is 72 and its bottom...

-

*please calculate irr in excel

-

Which of the following would not be a period cost? Research and development Direct materials Office supplies Advertising costs

-

\ table [ [ Activity Cost Pool,Activity Measure,Total Cost,Total Activity ] , [ Machining , Machine - hours,$ 3 3 0 , 0 0 0 , 1 5 , 0 0 0 MHs ] , [ Machine setups,Number of setups,$ 3 0 0 , 0 0 0 , 5...

Study smarter with the SolutionInn App