Using the information in P11-2B, compute the overhead controllable variance and the overhead volume variance. Data From

Question:

Using the information in P11-2B, compute the overhead controllable variance and the overhead volume variance.

Data From P11-2B,

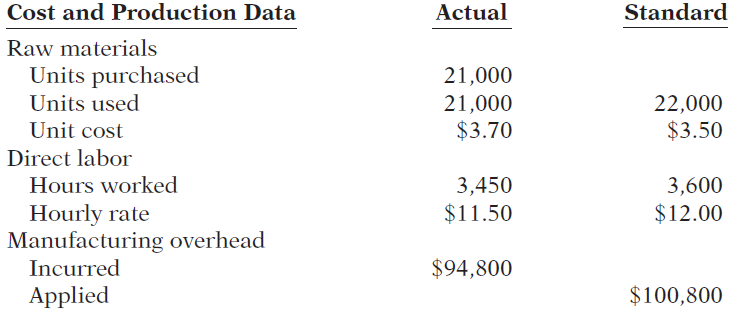

Huang Company uses a standard cost accounting system to account for the manufacture of exhaust fans. In July 2014, it accumulates the following data relative to 1,800 units started and finished.

Manufacturing overhead was applied on the basis of direct labor hours. Normal capacity for the month was 3,400 direct labor hours. At normal capacity, budgeted overhead costs were $16 per labor hour variable and $12 per labor hour fixed. Total budgeted fixed overhead costs were $40,800.

Jobs finished during the month were sold for $270,000. Selling and administrative expenses were $20,000.

Instructions

(a) Compute all of the variances for (1) direct materials and (2) direct labor.

(b) Compute the total overhead variance.

(c) Prepare an income statement for management. (Ignore income taxes.)

Step by Step Answer:

Managerial Accounting Tools for business decision making

ISBN: 978-1118096895

6th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso