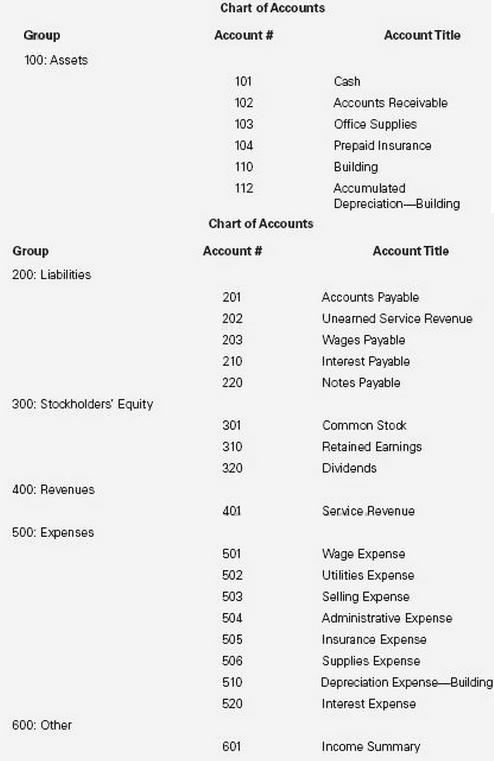

Using the information provided in P4- 3, perform the following steps: In P4-3 Required a. Journalize and

Question:

Using the information provided in P4- 3, perform the following steps:

In P4-3

Required

a. Journalize and post adjusting journal entries for Herman and Sons’ based on the following additional information:

• Of the cash payments received from customers on December 1, half of these services were performed in December and half relates to future services to be rendered in the following year.

• Ten months of the insurance policy expired by the end of the year.

• Depreciation for the full year should be recorded on the building purchased. The building has a 20 year life and no residual value. Depreciation will be recorded on a straight- line basis.

• A total of $ 15,000 of supplies remains on hand at the end of the year.

• Interest expense in the amount of $ 7,000 should be accrued on the note payable.

• Wages in the amount of $ 32,000 must be accrued at year end to be paid in January.

b. Prepare an adjusted trial balance as of December 31.

c. Prepare a single- step income statement, a statement of shareholders’ equity, and a balance sheet.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella