Variable and fixed costs in the wine industry, decision making A Votre Sant: Product Costing and Decision

Question:

Variable and fixed costs in the wine industry, decision making A Votre Santé: Product Costing and Decision Analysis in the Wine Industry3

Background

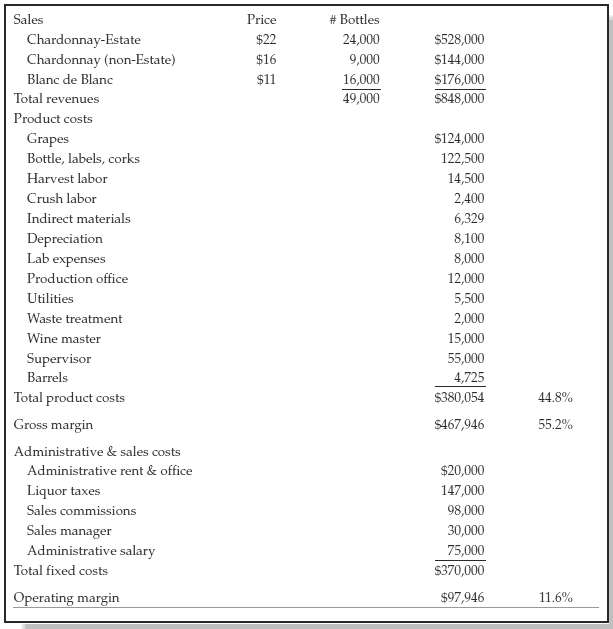

A Votre Santé (AVS) is a small, independent winery owned by Kay Aproveche. Kay has a relationship with a grower who grows two types of wine grapes, a Chardonnay and a generic white grape. AVS buys the grapes at the point at which they have ripened on the vine. AVS is responsible for harvesting the grapes and all further processing of the grapes into wine. In 2010, AVS earned an operating margin of almost $100,000 on sales of $848,000, for an 11.6% margin. The process of winemaking is fairly simple, yet requires much attention to process details. After the grapes are harvested, they are brought to the winery for washing and crushing. The crushing process separates the juice from the pulp, skin, and stems. The juice is used to make the wine; the pulp, skin, and stems are recycled back onto the fields whenever possible or otherwise disposed of. The amount of wine generated from the grapes is dependent each year on a number of climatic and growing factors such as temperature, length of growing season, rootstock, and fertilizers used.

Once the juice is extracted, it moves into the fermenting process. The Chardonnay wine grape is fermented using oak barrels; the oak in the barrels gives flavor to the Chardonnay wine. The barrels are expensive ($500 each), but are sold after four years for $200 apiece to another smaller winery. The juice fermenting in each barrel results in the production of 40 cases of wine. The generic white grape juices are fermented in a holding tank; a full tank would result in the production of 1,500 cases of wine. The fermenting process takes place in a temperature-controlled environment; however, each fermenting method results in some wine loss through evaporation. Kay Aproveche estimates that the Chardonnay will lose approximately 10% of its volume through the fermentation process, while the generic white will lose approximately 5% of its volume. Harvest takes place in the late summer and early fall months; typically, the time elapsed from harvest to final sale is about 11 months.

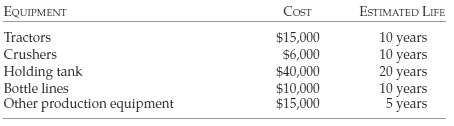

AVS bottles three wines: a Chardonnay-Estate, a regular Chardonnay, and a Blanc de Blanc. Data related to the three wines is as follows:??? Chardonnay-Estate contains only Chardonnay grapes that are grown for AVS; the expected sales price is $22/bottle. The market demand for Chardonnay-Estate wine is estimated to be 24,000 bottles for 2010.??? Regular Chardonnay is blended by combining the Chardonnay wine left over after bottling theChardonnay-Estate with the fermented generic wine; the blend mixture is two parts Chardonnay grapes (after fermentation) and one part generic grapes (after fermentation). The different grapes are fermented separately and blended at the end. The expected sales price is $16/bottle.??? Blanc de Blanc wine is made from all remaining generic white grapes; the expected sales price is $11/bottle.All three wines are bottled at AVS using one bottling line. In a typical year, AVS bottles enoughChardonnay-Estate to meet the predicted market demand, then bottles the regular Chardonnay after blending all remaining Chardonnay wine with the necessary amount of generic grapes. TheBlanc de Blanc is the last wine to be bottled, using all remaining generic white grapes. Kay again expects the wines from this harvest year to sell out.Additional Operational and Cost DataChardonnay Grapes??? 2009 harvest: 100,000 pounds??? Purchase price of $85,500??? Expected loss in volume through fermentation and bottling: 10%Generic White Grapes??? 2009 harvest: 60,000 pounds??? Purchase price of $38,500??? Expected loss in volume through fermentation and bottling: 5%Winemaking??? Chardonnay grapes are fermented in oak barrels; each barrel results in the production of 40 cases of wine.??? Barrels cost $500 apiece, and can be used for four years and sold for $200 each at the end of four years; assume that you have to purchase all new barrels for the 2009 harvest. The barrels are depreciated over 4 years.??? Generic white grapes are fermented in the holding tank; the tank can hold up to the equivalentof 1,500 cases of wine.Bottling??? Requires 36 pounds of grapes (post-fermenting) for one case (12 bottles) of wine.??? In the bottling process, the wine is put into bottles, with both corks and labels added during this process. The materials costs associated with the bottles, corks, and labels are estimated to be $2.50/bottle.Direct Labor??? Harvest labor is paid an average of $7.25/hour. It is estimated that 80 pounds of grapes can be harvested each hour.??? Crush labor is paid an average of $8.00/hour. It is estimated that it will take 300 hours to crush the grape harvest.Overhead Expenses??? Administrative rent and office expenses: estimated to be $20,000/year.??? Depreciation is charged based on the following equipment schedule:

??? Indirect materials: Part of the winemaking process involves introducing yeasts and other additives into the wine to help the fermentation process and to help balance the flavors in the wine.Indirect production materials average $1.55 per case of wine.??? Lab expenses: Lab expenses of $8,000 are incurred for lab supplies and equipment. The lab is used by the production supervisor and the wine master to test the grapes and wine at various stages of production.??? Liquor taxes: AVS is required to pay a liquor excise tax of $3/bottle on every bottle of wine sold.??? Production office: AVS pays a part-time person to help administer the production function. This person orders supplies, reviews and approves production invoices, and performs other administrative functions. The production office budget is estimated to be a flat rate of $12,000.??? Sales and related: Kay's sister, Maria, is paid $30,000/year on a contract basis to sell AVS wines.She works through distributors, who are paid $2/bottle for each bottle sold.??? Supervision: Kay's brother, Luis, supervises the production of wine from the harvest through the bottling processes. His salary and benefits total $55,000 annually.??? Utilities: Utility costs are incurred primarily to maintain a constant temperature in the fermenting process. These are expected to be $5,500.??? Waste treatment: After crushing, the pulp, skins, and stems that are left over must be disposed of. One-half of the waste can be recycled back onto the fields as a compost material; the other one-half must be disposed of at a landfill dumping cost of $2,000.??? A wine master is employed to help formulate and test the wines. This is done on a contract basis;AVS pays the wine master $5,000 for each type of wine that is formulated.??? Kay's role is to manage the AVS business. Her annual salary and benefits total $75,000.Required(a) Create a single company-wide contribution margin income statement (as in the "Total" column in Exhibit 3-6) for AVS that includes each expense category. Also calculate the average revenue and net income for one bottle of wine. (Note: Do not break out the variable or fixed costs by type of wine.)(b) Another grower has available 20,000 pounds of Chardonnay grapes from the 2009 harvest.AVS has the opportunity to buy the juice from these grapes (they have already been harvested and crushed). If AVS could blend these grapes with the generic white grapes (using the 2:1 blend formula) to produce a new Chardonnay wine to be priced at $14/bottle, and require a 15% return on sales for this wine, what is the maximum amount that AVS would pay for a pound of Chardonnay grapes?(c) Other than the cost of the grapes seen in part b, what factors would you consider to support your purchase of the grapes, and what factors would cause you to reject buying thegrapes?

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes...

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young