Variable costs per unit for two products made by the Flibberty Gibbet Company are shown below. Flibberty

Question:

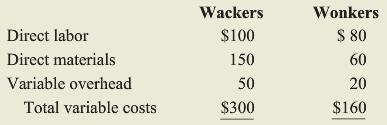

Variable costs per unit for two products made by the Flibberty Gibbet Company are shown below.

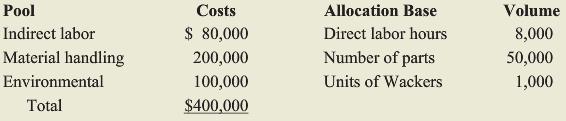

Flibberty Gibbet managers have not kept up with more recent costing methods, and they allocate fixed manufacturing overhead based on direct labor hours. Each product requires two direct labor hours, and the cost pool for fixed manufacturing overhead is $400,000 during a period when about 8,000 direct labor hours are used. Wackers sell for $600 each and Wonkers sell for $400 each. The company recently hired a new accountant who decided to develop a more current method to allocate fixed manufacturing overhead costs, especially the costs related to disposal of hazardous waste chemicals used in the manufacturing process for Wackers. The accountant developed a simple ABC costing system by separating fixed manufacturing overhead costs into the following three new cost pools. Current year information for each cost pool follows.

Wackers have 11 parts, and Wonkers has 8 parts.

REQUIRED

A. Use the current allocation system (direct labor hours) to allocate fixed manufacturing overhead costs, and calculate the net profit for each unit of Wackers and Wonkers.

B. Use the new ABC system to allocate fixed manufacturing overhead costs, and calculate the net profit for each unit of Wackers and Wonkers.

C. Explain why the results from part (A) are different from the results in part (B).

Step by Step Answer:

Cost Management Measuring Monitoring And Motivating Performance

ISBN: 392

2nd Edition

Authors: Leslie G. Eldenburg, Susan K. Wolcott