Question: Visic Corporation, a manufacturing company, produces a single product. The following information has been taken from the companys production, sales, and cost records for the

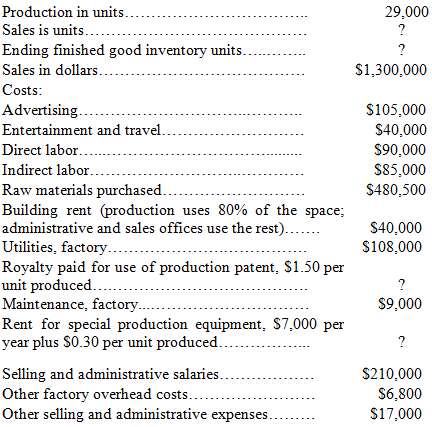

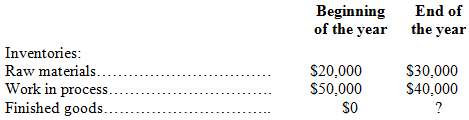

Visic Corporation, a manufacturing company, produces a single product. The following information has been taken from the companys production, sales, and cost records for the just completed year.

The finished goods inventory is being carried at the average unit production cost for the year. The selling price of the product is $50 per unit.

Required:1. Prepare a schedule of cost of goods manufactured for the year.2. Compute the following.a. The number of units in the finished goods in inventory at the end of the year.b. The cost of the units in the finished goods in inventory at the end of the year.3. Prepare an income statement for the year.

Production in units. 29,000 Sales is units.... Ending finished good inventory units. $1,300,000 Sales in dollars.. Costs: Advertising.. $105,000 Entertainment and travel. S40,000 Direct labor.. S90,000 $85,000 Indirect labor.. Raw materials purchased.. Building rent (production uses 80% of the space; administrative and sales offices use the rest).... Utilities, factory... Royalty paid for use of production patent, $1.50 per unit produced... Maintenance, factory.. Rent for special production equipment, $7,000 per year plus S0.30 per unit produced.. S480,500 S40,000 S108,000 $9,000 $210,000 $6,800 Selling and administrative salaries.. Other factory overhead costs... Other selling and administrative expenses. $17,000

Step by Step Solution

3.31 Rating (175 Votes )

There are 3 Steps involved in it

1 2 3 Visic Corporation Schedule of Cost of Goods Manufactured Direct materi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C (50).docx

120 KBs Word File