Question: Weighted-average method, spoilage. The Boston Company is a food-processing company based in San Francisco. It operates under the weighted-average method of process costing and has

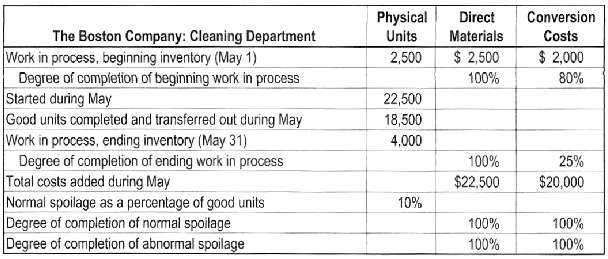

Weighted-average method, spoilage. The Boston Company is a food-processing company based in San Francisco. It operates under the weighted-average method of process costing and has two departments: Cleaning and Packaging. For the Cleaning Department conversion costs are added evenly during the process, and direct materials are added at the beginning of the process. Spoiled units are detected upon inspection at the end of the process and are disposed of at zero net disposal value. All completed work is transferred to the Packaging Department. Summary data for May follow:

For the Cleaning Department summarize total costs to account for, and assign total costs to units completed and transferred out (including normal spoilage), to abnormal spoilage, and to units in ending work in process. Carry unit-cost calculations to four decimal places when necessary. Calculate final totals to the nearest dollar. (Problem 18-32 explores additional facets of thisproblem.)

Physical Units Direct Conversion The Boston Company: Cleaning Department Work in process, beginning inventory (May 1) Degree of compietion of beginning work in process Started during May Good units completed and transferred out during May Work in process, ending inventory (May 31) Degree of completion of ending work in process Total costs added during May Normal spoilage as a percentage of good units Degree of completion of normal spoilage Degree of completion of abnormal spoilage Materials Costs $ 2,500 $ 2,000 2,500 100% 80% 22,500 18,500 4,000 100% 25% $22,500 $20,000 10% 100% 100% 100% 100%

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Weightedaverage method spoilage Solution Exhibit 1830 summarizes total costs to account forcalculate... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-S-S (30).docx

120 KBs Word File