You are the audit manager for Ken- Ron Enterprises. Your firm has been the entitys auditor for

Question:

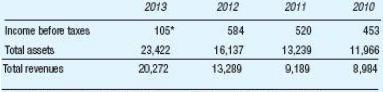

You are the audit manager for Ken- Ron Enterprises. Your firm has been the entity’s auditor for 15 years. Your firm normally uses a range of 3% to 5% of income before taxes to calculate overall materiality and 50– 75% of over-all materiality to calculate tolerable misstatement. Ken- Ron has reported the following financial statement data (in millions) for the last four years:

Required:

a. If you planned on using income before taxes as the benchmark to compute overall materiality and tolerable misstatement, how would you compute those amounts for 2013? Prepare and justify your calculations.

b. Determine overall materiality and tolerable misstatement using either total assets or total revenues as the benchmark. Make the calculations by utilizing both .25% and 2%, the endpoints of the range that your Firm’s guidance provides.

c. Assume that during the course of the 2013 audit you discovered misstatements totaling $ 50 million (approximately 50% of the 2013 income before taxes of $ 105 million). Discuss whether this amount of misstatement is material given your benchmark calculations from parts a. and b. above.

Step by Step Answer:

Auditing and Assurance Services A Systematic Approach

ISBN: 978-1259162343

9th edition

Authors: William Messier, Steven Glover, Douglas Prawitt