You are the new manager of the local GreatBuy Electronics store. Top management of GreatBuy Electronics is

Question:

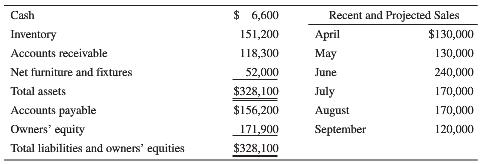

You are the new manager of the local GreatBuy Electronics store. Top management of GreatBuy Electronics is convinced that management training should include the active participation of store managers in the budgeting process. You have been asked to prepare a complete master budget for your store for June, July, and August. All accounting is done centrally so you have no expert help on the premises. In addition, tomorrow the branch manager and the assistant controller will be here to examine your work; at that time, they will assist you in formulating the final budget document. The idea is to have you prepare the initial budget on your own so that you gain more confidence about accounting matters. You want to make a favorable impression on your superiors, so you gather the financial statement and sales data as of May 31, 20X8, on the top of the next page.

Credit sales are 70% of total sales. Seventy percent of each credit account is collected in the month following the sale and the remaining 30% is collected in the subsequent month. Assume that bad debts are negligible and can be ignored. The accounts receivable on May 31 are the result of the credit sales for April and May:

(.30 * .70 * +130,000) + (1.0 * .70 * +130,000) = +118,300.

The policy is to acquire enough inventory each month to equal the following month’s projected cost of goods sold. All purchases are paid for in the month following purchase.

The average gross profit on sales is 37%. Salaries, wages, and commissions average 24% of sales; all other variable expenses are 3% of sales. Fixed expenses for rent, property taxes, and miscellaneous payroll and other items are $9,000 monthly. Assume that these variable and fixed expenses require cash disbursements each month. Depreciation is $1,000 monthly.

In June, $5,000 is going to be disbursed for fixtures acquired and recorded in furniture and fixtures in May. The May 31 balance of accounts payable includes this amount.

Assume that a minimum cash balance of $4,000 is to be maintained. Also assume that all borrowings are effective at the beginning of the month and all repayments are made at the end of the month of repayment. Interest is compounded and added to the outstanding balance each month, but interest is paid only at the ends of months when principal is repaid. The interest rate is 9% per year; round interest computations and interest payments to the nearest dollar. Interest payments may be any dollar amount, but all borrowing and repayments of principal are made in multiples of $1,000.

1. Prepare a budgeted income statement for the coming June–August quarter, a cash budget for each of the 3 months, and a budgeted balance sheet for August 31, 20X8. All operations are evaluated on a before-income-tax basis, so income taxes may be ignored here.

2. Explain why there is a need for a bank loan and what operating sources supply cash for repaying the bank loan.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Cash Budget

A cash budget is an estimation of the cash flows for a business over a specific period of time. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payment. Its primary purpose is to provide the...

Step by Step Answer:

Introduction to Management Accounting

ISBN: 978-0133058789

16th edition

Authors: Charles Horngren, Gary Sundem, Jeff Schatzberg, Dave Burgsta