You have an option to purchase all of the assets of the Overland Railroad for $2.5 billion.

Question:

You have an option to purchase all of the assets of the Overland Railroad for $2.5 billion.

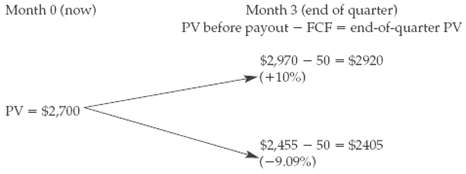

The option expires in 9 months. You estimate Overland?s current (month 0) present value (PV) as $2.7 billion. Overland generates after-tax free cash flow (FCF) of $50 million at the end of each quarter (i.e., at the end of each three-month period). If you exercise your option at the start of the quarter, that quarter?s cash flow is paid out to you. If you do not exercise, the cash flow goes to Overland?s current owners. In each quarter, Overland?s PV either increases by 10 percent or decreases by 9.09 percent. This PV includes the quarterly FCF of $50 million. After the $50 million is paid out, PV drops by $50 million. Thus the binomial tree for the first quarter is (figures in millions):

The risk-free interest rate is 2 percent per quarter.

(a) Build a binomial tree for Overland, with one up or down change for each 3-month period (three steps to cover your 9-month option).

(b) Suppose you can only exercise your option now, or after 9 months (not at month 3 or 6). Would you exercise now?

(c) Suppose you can exercise now, or at month 3, 6, or 9. What is your option worth today? Should you exercise today, or wait?

Free Cash FlowFree cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets. Unlike earnings or net income, free cash flow is a measure of profitability that excludes the...

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers