Question: You plan to invest in the Kish Hedge Fund, which has total capital of $500 million invested in five stocks: Kishs beta coefficient can be

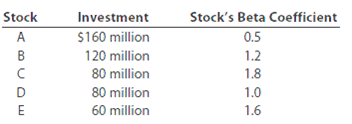

You plan to invest in the Kish Hedge Fund, which has total capital of $500 million invested in five stocks:

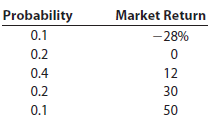

Kish’s beta coefficient can be found as a weighted average of its stocks’ betas. The risk-free rate is 6%, and you believe the following probability distribution for future market returns is realistic:

a. What is the equation for the Security Market Line (SML)?

b. Calculate Kish’s required rate of return.

c. Suppose Rick Kish, the president, receives a proposal from a company seeking new capital. The amount needed to take a position in the stock is $50 million, it has an expected return of 15%, and its estimated beta is 1.5. Should Kish invest in the new company? At what expected rate of return should Kish be indifferent to purchasing the stock?

Investment $160 million 120 million 80 million 80 million 60 million Stock's Beta Coefficient 0.5 1.2 1.8 1.0 1.6 Stock A B

Step by Step Solution

3.31 Rating (169 Votes )

There are 3 Steps involved in it

a r RF 6 given Therefore the SML equation is r i r RF r M r RF b i 6 13 6b i 6 7b i b ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

43-B-A-I-A (436).docx

120 KBs Word File