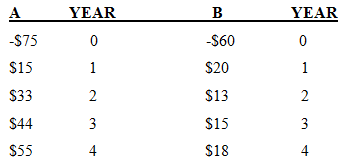

Your firm is considering two projects: Project A and Project B with the following cash flows: a.

Question:

Your firm is considering two projects: Project A and Project B with the following cash flows:

a. Calculate the NPVs based on WACCs of 5% and 7%

b. What are the IRRs based on the WACCs?

c. Calculate the payback period and discounted payback period

d. Which projects should the firm accept if they are independent, based on the NPV, IRR, payback period, and discounted payback period methods? Assume your firm requires projects to break even in three years

Payback PeriodPayback period method is a traditional method/ approach of capital budgeting. It is the simple and widely used quantitative method of Investment evaluation. Payback period is typically used to evaluate projects or investments before undergoing them,...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-1133541141

13th edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: