From Limited has a non-contributory, defined benefit pension plan. Pension plan data to be used for accounting

Question:

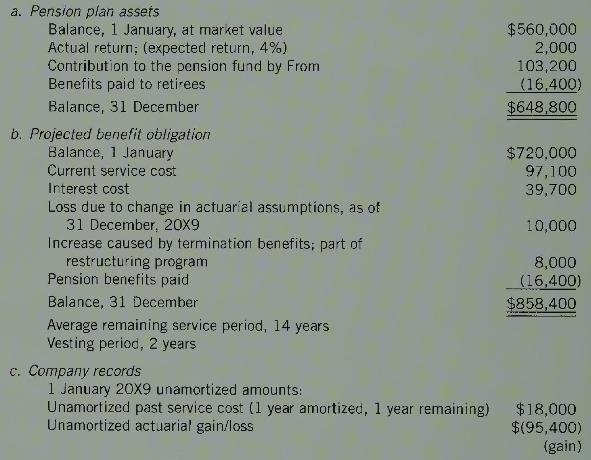

From Limited has a non-contributory, defined benefit pension plan. Pension plan data to be used for accounting purposes for the 20X9 year are as follows (in \(\$\) thousands):

Required:

1. Calculate pension expense for 20X9. The company follows the practice of amortizing actuarial gains and losses to pension expense when the 1 January amount is outside the \(10 \%\) corridor.

2. Calculate the amortization of relevant amounts for \(20 \mathrm{X} 9\), and the unamortized amounts for carryforward.

3. Give the 31 December \(20 X 9\) entries to record pension expense and funding for From.

4. Recalculate your response to requirement 1 assuming that this is a private company that has elected to use the simplified approach to pension accounting. Assume that there are no carryforwards of past service cost or actuarial gains in this requirement.

Step by Step Answer: