HTR Resources Ltd. has a non-contributory defined bencfit pension plan for its employees. At the beginning of

Question:

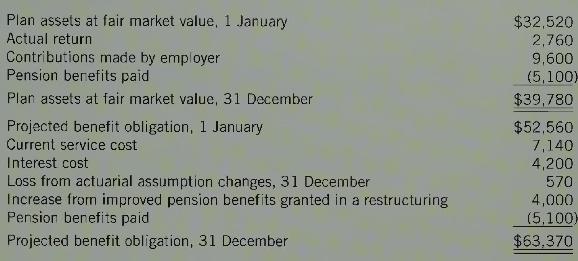

HTR Resources Ltd. has a non-contributory defined bencfit pension plan for its employees. At the beginning of \(20 \times 8\), there is unrecognized past service cost of \(\$ 4,380\) and unrecognized actuarial losses of \(\$ 5,460\) (all amounts in thousands). The data for \(20 \mathrm{X} 8\) is as follows:

HTR amortizes gains or losses based on opening balances using the corridor method. The vesting period is 12 years and ARSP is 18 years. The expected rate of return on fund assets is \(7 \%\).

Required:

1. Compute the accrued pension liability/asset on the statement of financial position at 1 January \(20 X 8\).

2. Prepare the \(20 X 8\) journal entry to record pension expense.

3. Compute the accrued pension liability/asset on the statement of financial position at 31 December 20X8.

Step by Step Answer: